Taking Profits In Europe, International Stocks

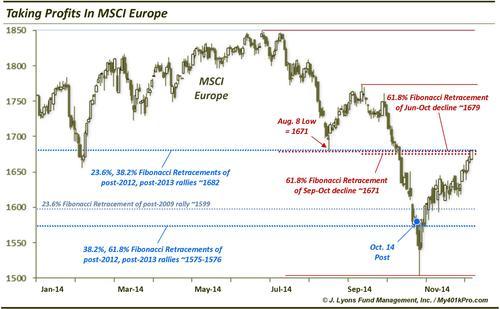

On October 14 and October 17, we published posts highlighting major Fibonacci support areas being tested by the MSCI Europe Index and the MSCI EAFE Index, respectively. At the time, the downward momentum in these indices was fierce. We stated in the EAFE post that “we are not fans of trying to catch falling knives. However, when we do, it is only into significant support”. We deemed the support levels highlighted relevant to each index to indeed be “significant”. Therefore, although we noted in the Europe post that the risk was “greater right now that indexes will “overshoot” potential support levels”, as long as the indices could reclaim the key levels, “it could set the index(es) up for a significant rally, at least in the intermediate-term.”

The indices did overshoot temporarily – for 1-2 days – before quickly reclaiming their important levels, positioning each of them for a rally. Rallies have indeed unfolded since that time. Since the impetus for buying these areas was a mean reversion bounce from major resistance, the expectation was only a tradable bounce. Thus, rather than our typical philosophy of buying relative strength and holding until the strength fades, the objective here was to sell on a bounce into resistance. In our view, the indices are now at such resistance.

In the MSCI Europe, current resistance is represented by three key levels around 1680:

- September breakdown level marked by the August low

- 50% Fibonacci Retracement of the June-October decline

- 61.8% Fibonacci Retracement of the September-October decline

In the MSCI EAFE, current resistance is represented by two key levels around 1845:

- 50% Fibonacci Retracement of the June-October decline

- 61.8% Fibonacci Retracement of the September-October decline

To summarize, the MSCI EAFE and Europe Indices exhibited the mean-reversion bounces hoped for off of their October lows. Since these indices are not currently displaying what we consider longer-term relative strength, current levels represent an attractive place to take profits/reduce exposure.

*Not a recommendation*

____

“Sub cash register” photo by Franck Blais.

Read more from Dana Lyons, JLFMI and My401kPro.