Energy Fund Assets Run Dry

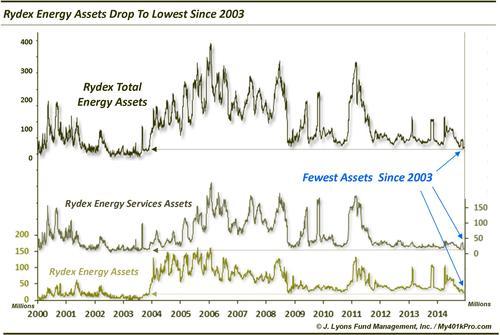

One of the casualties of the rout in oil prices and associated stocks, not surprisingly, has been the amount of assets invested in related energy funds. One such example of the decline in energy related assets comes from the Rydex family of mutual funds. Just how bad has it been? The assets in both the Rydex Energy Fund and the Rydex Energy Services Fund have dropped to their lowest levels since the bull market in energy stocks began in 2003.

While it is not surprising to see the energy fund assets drop significantly given the decline in oil and oil-related stocks, the new lows are a bit surprising. This is especially so considering the magnitude of the recent price decline versus the 2008 crash.

Specifically, the decline in both the price of oil and oil stocks (using the XOI Oil Index) in 2008 was roughly twice as bad as our present situation. Oil lost about 80% in 2008 versus 40% today and the XOI lost 55% versus 23% just recently. We understand that there has been a secular decline in mutual fund assets due to the rise in ETF popularity, However, the fact that energy fund assets have dipped below even the 2008-2009 lows despite suffering only half of the losses is somewhat alarming.

So has the pessimism been overdone? Is it time to dip one’s toes back into energy stocks? As they say, the time to buy is when there is blood running in the streets. You could certainly make a case for that now (although at times like these, a good deal of the blood is often from traders trying to catch the falling knife). While we prefer to buy relative strength areas (i.e., those that are performing the best), there is historical evidence that a bounce may be in order for these energy stocks.

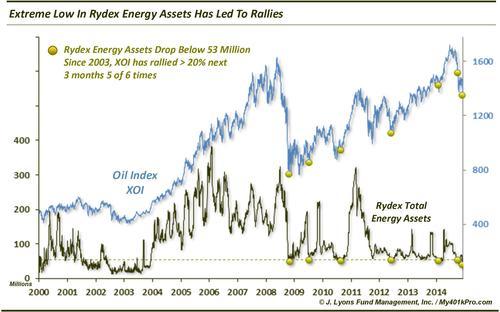

Since the beginning of the bull market in energy stocks began in 2003, total Rydex energy fund assets have dropped below 53 million on 6 distinct occasions prior to the present situation. In 5 of the 6 cases, the XOI Oil Index rallied by at least 20% over the following approximate 3 month period.

Perhaps the troublesome thing is that the only time oil stocks did not rally 20% was following the occurrence in early October of this year (although after falling a bit more, it did manage a 10% bounce off of the mid-October lows).

As judged by the assets in energy funds (or perhaps we should say not in energy funds), the well has run dry. Rydex energy sector assets have never been as low as they are now since the bull market in energy stocks kicked off in 2003. While we are not fans of knife-catching, based on historical precedents, oil stocks may be positioned for at least a reflexive bounce sometime soon.

An upcoming post will detail why the chart supports this bounce notion.

____

“Oil Well” photo by the great 8.

Read more from Dana Lyons, JLFMI and My401kPro.