Traders Are Shunning Hedges Again

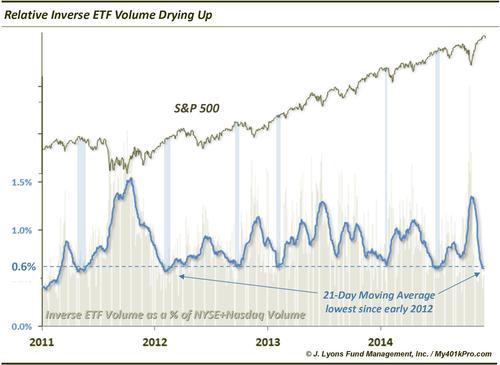

One of our favorite new indicators for gauging investor sentiment the past few years has been the level of volume in inverse equity ETF’s. To refresh, these ETF’s go up when the stock market goes down and vice-versa. Monitoring the trading activity in these instruments, we see that volume typically spikes during market selloffs as traders seek protection and it typically dries up during prolonged rallies as traders become more complacent. When inverse ETF volume hits an extreme in one direction, it has often been a contrarian tip off that the market is close to changing direction.

Our last post covering this topic came on October 17. In the post, we noted that relative inverse ETF volume (i.e., as a percentage of total NYSE plus Nasdaq volume), hit an all-time high on October 15. In fact, it was about 25% higher than the previous record set on October 4, 2011. Thus, we surmised that “based on a comparison with the previous record, the recent reading again appears more than sufficient to satisfy an end or ending to the decline.” We concluded that “this week’s record spike in inverse ETF volume is a positive sign that traders have become too fearful, thus opening up the market to a bounce.”

And bounce, it did. Another V-bottom low resulted in stocks immediately shooting higher from that point to new highs. Along the way, traders have become comfortable once again operating without hedges as evidenced by the inverse ETF indicator coming full circle. Over the past month, volume in those instruments has dried up. So much so, in fact, that the 21-day (approximately 1 month) moving average of relative inverse ETF volume has fallen to its lowest level in almost 3 years.

The last time relative inverse ETF volume dropped as low as it is now was in early 2012, and May 2011 before that. Since 2011, current levels (around 0.6%) of the indicator’s 21-day moving average have coincided with short to intermediate-term tops in the market, even despite the strong overall environment. The one exception was in early 2013 when stocks just kept going up unimpeded. In the other cases, stocks either topped soon after, or else whatever gains they did manage over the short-term were eventually wiped out.

There are plenty of concerns and red flags regarding the stock market at this point. We have certainly brought to light many of them, including this dearth of volume in inverse ETF’s. By themselves, these concerns don’t necessarily mean the end of a rally, short-term or longer (especially, given positive seasonality now). However, they do present a picture of the potential risk baked into the market should it turn.

And perhaps that is the most important takeaway from this low volume condition in inverse ETF’s. Traders have likely very little money currently allocated to hedges. Any market selloff, therefore, would necessarily be quite painful without any positions to soften the blow. The danger then is that considering the pressure that will arise to reduce exposure, either through selling longs or adding hedges, any such selloff at this point is liable to be exacerbated.

______

“Dark Hedges” photo by Andrew Gibson.

Read more from Dana Lyons, JLFMI and My401kPro.