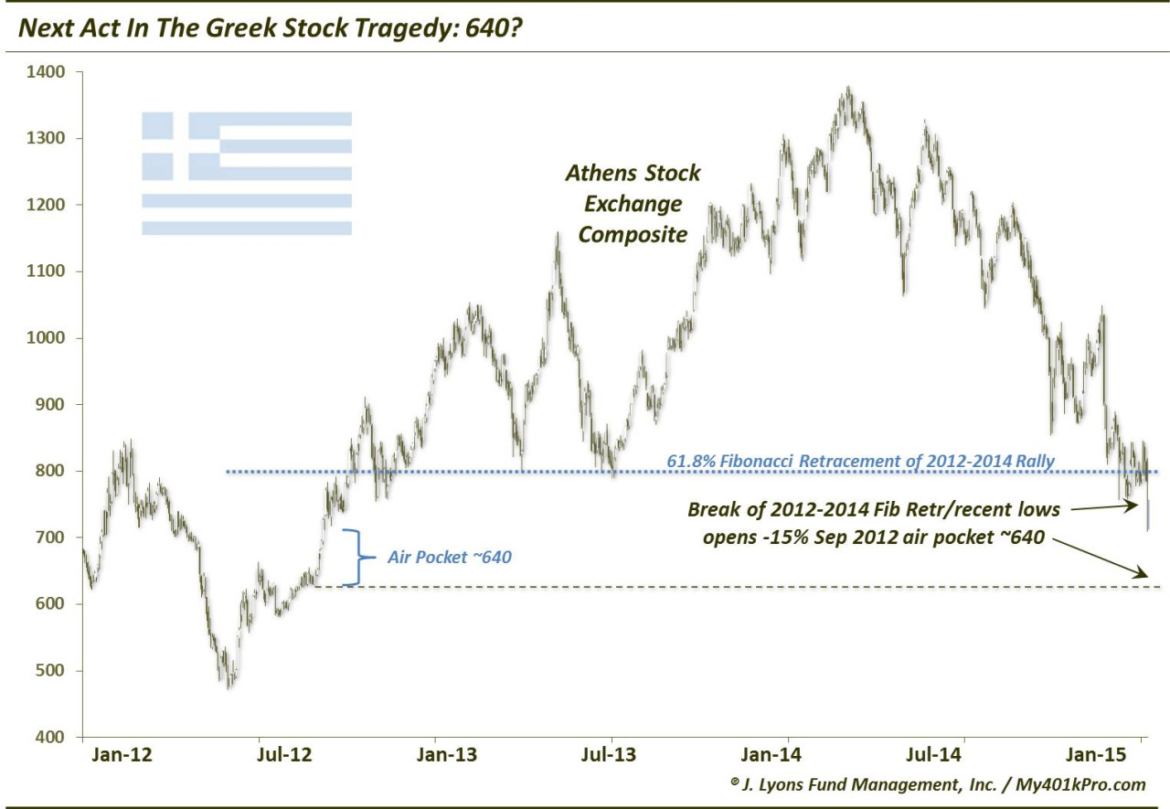

Next Act In The Greek Stock Tragedy: 640?

On May 14, we noted the long-term challenges facing Greece’s stock market and that “another Greek tragedy was forthcoming”. Sure enough, the market dropped roughly 20% into August. After a brief bounce into October, the Athens Stock Market broke below those August (and May) lows near 1000. This breakdown prompted an October 8 post in which we highlighted the likelihood of a second act in the Greek tragedy that would take the market down into the 700’s. It reached that level, falling nearly 30% into the end of December.

Those December lows roughly matched the October-November 2012 lows as well as the April and June 2013 lows. This was also the approximate 61.8% Fibonacci Retracement of the 2012-2014 rally. That level was decisively broken this week. That is key since this break brings the Athens Stock Market prices into an air pocket of sorts dating back to September 2012. That signified a 1-week post-Draghi “whatever it takes” jump from around 640 to around 780. Thus, breaking the 780 level puts the market into the air pocket and at risk of reaching that 640 level…and fast.

That drop would equate to about an 18% drop from the 780 level, or an 11% drop from today’s closing price around 722. If folks are looking for an “oversold” bounce from Greece to support global equities, they may not get it until that 640 level. At least we would not be attempting an oversold play until this act of the tragedy reaches that level. Although, considering the moves this week, that could occur in 1 day.

________

More from Dana Lyons, JLFMI and My401kPro.