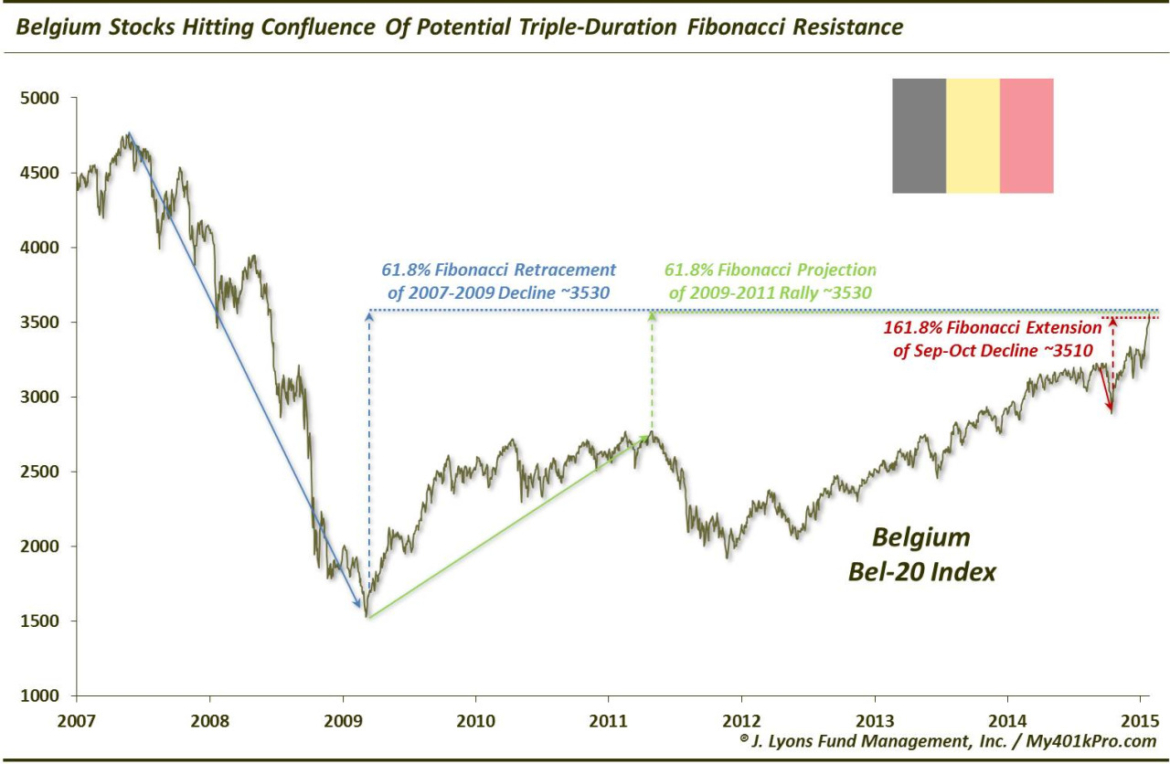

Belgium Stock Market At Potential Confluence Of Resistance

In December, we noted the relative strength of the Northern European stock markets. This included Belgium. Additionally, last Tuesday we commented that the European markets appeared poised to “blast higher”. While that post referred to the broad STOXX Europe 600 index, the Belgium Bel-20 Index was also poised to make a move higher. Indeed, over the past week it has done so, soaring some 6% to new 52-week highs. At current prices, however, the Bel-20 may encounter some resistance in the form of 3 key Fibonacci levels spanning 3 different durations:

- 61.8% Fibonacci Retracement of the 2007-2009 Decline ~3530

- 61.8% Fibonacci Projection of the 2009-2011 Rally ~3530

- 161.8% Fibonacci Extension of the September-October Decline ~3510

The Bel-20 Index closed yesterday close to 3550, just above the listed levels. However, it did pull back today to close right on that key 3530 level. We are not suggesting this is the end of the road for the Belgium rally, or other Northern European markets that have likewise broken out. However, given these key Fibonacci levels and the strong gains over the past week, the market may need to consolidate some before moving higher again. In other words, don’t be surprised if Belgian stocks waffle here for a little bit (sorry.)

________

More from Dana Lyons, JLFMI and My401kPro.Europe