European Stocks Set To Blast Higher?

The financial media tells us that the European economic situation is a mess. We agree. However, one lesson that is reinforced on a daily basis across the globe is that a country’s stock market is not necessarily representative of its economy at any given time. So it is with regional indices as well. Look no further than what is developing in one of the broadest European stock indexes at the present time.

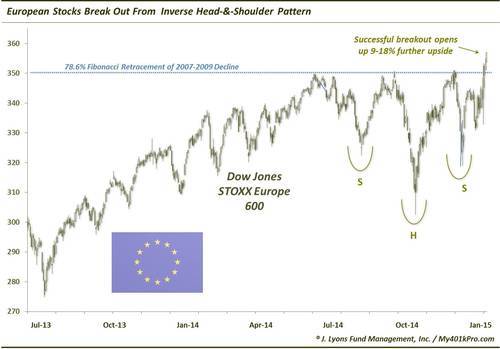

While there are certainly trouble spots around the continent (e.g., the PIIGS as we have pointed out), there are apparently enough bright spots (such as the Northern European markets that we have discussed) to boost the Dow Jones STOXX Europe 600, an index of 600 stocks from around the continent, to 7-year highs over the past 2 days. This is a significant development for the index which had topped back in June (at the 78% Fibonacci Retracement of the 2007-2009 decline) and failed in September and December attempts to surpass those highs. In the process, however, the STOXX 600 formed a bullish inverse head-&-shoulder pattern, with the August and December lows marking the shoulders and the October low representing the head. This pattern was confirmed by the present breakout.

Obviously the breakout needs to hold (or follow-through) for several days in order to instill confidence that it is indeed a successful breakout. We have mentioned many times recently that over the past few years, breakouts have tended to fail as often as they have succeeded. So while the breakout looks textbook, the proof is still in the pudding. If it is indeed successful, what sort of potential are we talking about for the DJ STOXX Europe 600? While we are not big proponents of setting targets, we could reasonably expect either of the following 2 levels to be reached, given a successful breakout. They are each based on a measurement of the range encompassed by the inverse head-&-shoulder pattern:

- The 61.8% Fibonacci Extension of the range would bring the index to about the 380 level, an approximate 9% gain.

- A 100% extension of the range would target the 2000 and 2007 All-Time Highs around 400, an 18% lift.

A couple things to note. We are always loathe to attach a “reason” for a particular market move. That said, we are reasonably confident that the anticipation of this week’s announcement of quantitative easing out of the European Central Bank has played a role in the recent rally. Therefore, the release of the ECB’s decision (and more importantly, the reaction to the release) will obviously have a substantial impact on the movement of the STOXX 600, at least in the short-term. So, how does one play that? In our view, it’s simple: one doesn’t play it. Only price is truth, so that’s all one needs to watch. We don’t care what the “reason” was for a particular move nor what it will be for an upcoming move. All we care about is the move.

Therefore, keep an eye on the breakout level around 350. If the DJ STOXX 600 is able to hold above there, the targets we mentioned are not out of the question. If the breakout fails immediately, then perhaps this attempted launch was a dud.

____

“Euro Man” photo by Rock Cohen.

Read more from Dana Lyons, JLFMI and My401kPro.