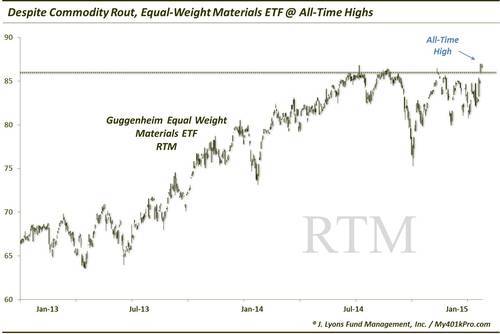

Despite Commodity Rout, Materials Sector Is At All-Time Highs

People often ask us why we rely on objective, quantitative models to identify investment opportunities as opposed to popular theory, forecasts or intuition. One reason is that it assists us in avoiding perception bias. That is, the objective models are able to see conditions as they are rather than how we think they must be given the circumstances. A case in point: with the rout in commodities over the past 6 months, common perception may be that materials stocks are struggling in sympathy. A bias-free quantitative model would tell you that is not the case. In fact, would you believe that a broad collection of materials stocks is actually at an all-time high? Believe it.

As of a few days ago, the Guggenheim Equal Weight Materials ETF (ticker,

RTM) did indeed hit an all-time high. The RTM, as its name implies, weights each of its holdings essentially the same, rather than the typical cap-weighted method. This way, the movement of 1 or 2 stocks alone is not likely to dictate the direction of the fund. Rather, a majority of the stocks need to be moving in one direction in order to get the fund going that way. In this case, the majority of materials stocks are rallying soundly, thus placing the ETF at an all-time high, a quite unexpected development given the commodity declines.

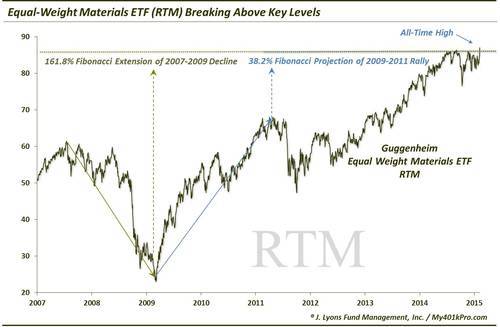

The location of the level from which the RTM recently broke out is noteworthy for a few reasons. The prior high point lines up precisely with two key Fibonacci levels:

- 161.8% Fibonacci Extension of 2007-2009 Decline

- 38.2% Fibonacci Projection of 2009-2011 Rally

If the breakout is successful, the breaching of these key barriers may provide further, material (no pun intended) upside potential, starting perhaps with the 61.8% Fibonacci Projection of the 2009-2011 rally (near $97, or 11% higher).

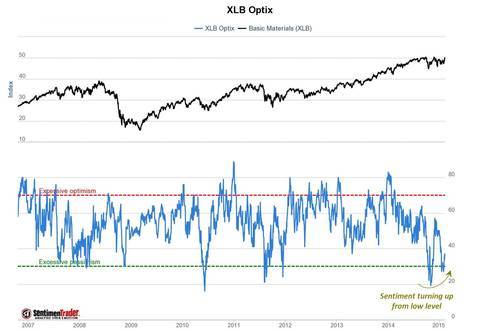

Lastly, a look at the sentiment picture for the sector is quite telling. From the terrific www.SentimenTrader.com service, we see that sentiment appears to be perhaps stricken with perception bias. According to SentimenTrader’s proprietary models, sentiment on the materials sector, specifically on the popular SPDR Material ETF, XLB, is only just emerging from an extreme bearish condition. Similar extreme bearish levels have led to bottoms in the XLB and powerful rallies. This suggests, perhaps, that there is plenty of room aboard the materials bandwagon before it gets “overbought” or “overcrowded”.

So we have a broad materials sector ETF at all-time highs, breaking above key resistance levels. At the same time, we have near-extreme low sentiment toward the sector, thanks likely to subjective perception bias stemming from the bear market in commodities. This is why we use objective, quantitative models in our investment selection. These models can locate opportunities in areas that, due to human nature, we may never even look at. Provided it can hold above the key breakout area, the Equal-Weight Materials ETF, RTM, may represent just such an opportunity.

________

“Earthworms” photo by United Nations Development Programme

More from Dana Lyons, JLFMI and My401kPro.