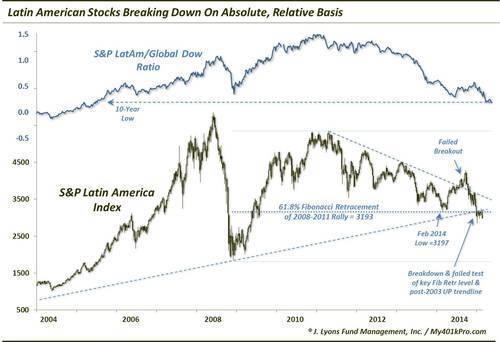

Latin American Stocks Breaking Down On Relative & Absolute Basis

We’ve gone globe-trotting with some of our posts recently in highlighting good news around the equity world. Whether recent new highs (in Europe) or all-time highs (in Asia), there are plenty of positive developments among the equity markets in the world. Latin America, however, is not one of them.

In reviewing our charts and posts from 2014, we got an awful lot of things right (though, we’re a little biased). One item that did not unfold as positively as we thought it might was the performance of the Latin American equity market. What looked like a potential longer-term bottom during the 1st half of the year did not materialize. In fact, things look worse than ever for the region.

After essentially crashing in 2008 – the S&P Latin America Index lost 68%, or 4000.04 points in 5 months – LatAm stocks rebounded into 2011, gaining back about 3500 points. Since then, they have slowly dripped lower, however. In February of last year, the S&P Latin America Index came within 0.1% of the all important 61.8% Fibonacci Retracement of the 2008-2011 rally and bounced immediately off that level. This was the first step, we wrote, in a potential bottoming scenario.

The second step occurred a month later as the index successfully tested that low and proceeded to shoot higher. A third and fourth positive development followed as the index broke the post-2011 downtrend and made a higher high in July. Since that point, however, the index began to unravel. The biggest blow came in December as the index broke below that 61.8% Fibonacci Retracement level of the 2008-2011 rally.

In the process, the S&P Latin America Index also broke below the post-2003 UP trendline which had connected the 2008 lows. Allowing for the possibility of a false breakdown, the index may have been given the benefit of the doubt as it attempted to regain that key level. In the last several weeks, the index did indeed make a run at that level. However, it was decisively rejected by the combination of the Fibonacci Retracement and post-2003 trendline. Thus, we have a serious breakdown in absolute terms.

On a relative basis, Latin American stocks do not look any better. In fact, they look worse. Comparing its performance to the Global Dow, the S&P Latin America Index made a relative low last February in the vicinity of the low in 2008. However, after its bounce into September, the relative ratio to the Global Dow has made a new low. In fact, it has made a near 10-year low going all the way back to early 2005. Thus, the relative breakdown.

Obviously the strong dollar and the decline in commodity prices have hurt this region’s stock markets. Given the developing serious breakdowns on an absolute and relative basis, the risk of further declines in Latin American stocks is exceedingly high right now. And considering there is no shortage of strong-acting markets around the world at the moment, it is difficult to conceive of a reason to allocate investment dollars to this region in the short to intermediate-term.

________

More from Dana Lyons, JLFMI and My401kPro.