“Everything Is Awesome” Brought To You By The Fed

Some days, the stock market soars at the expense of bonds. Other days, it is commodities like oil or gold that shine. And some days, defensive assets like bonds catch a big bid. Then there are those rare days when all asset classes enjoy big rallies – days when “Everything Is Awesome”! (phrase borrowed from the Grammy-nominated song from The Lego Movie…seriously.) We saw such a day yesterday with stocks, bonds, crude oil and gold, not to mention the Euro, all up more than 1%.

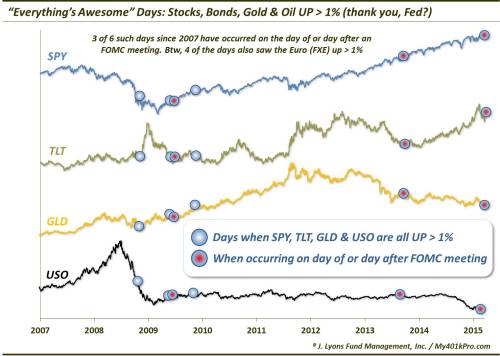

This has been a rare feat over the past 8 years. As measured by the most popular ETF’s covering stocks (SPY), bonds (TLT), oil (USO) and gold (GLD), this was just the 6th day since 2007 that each of the asset classes rallied 1% on the same day.

Here are the 6 dates in the past 8 years (* Euro [FXE] also up > 1%):

- 11/4/2008*

- 5/29/2009*

- 6/25/2009

- 11/16/2009

- 9/18/2013*

- 3/18/2015*

Truthfully, there is not a lot that we found to be gleaned from these dates in terms of adding value to market expectations. The first 1, and maybe 4, occurred within the descent/ascent associated with the outright market panic during the financial crisis. Given the elevated volatility during such times, it is not a shock that several of the occurrences would be found during that period (although, it was still rare to have all the asset classes going the same way, i.e., up).

In most instances, these dates marked little significance in terms of the future direction of the various markets. There were a few exceptions when the dates marked an inflection point for a certain asset, i.e., the 2008 instance that sent bonds and gold sailing upward and, to a lesser extent, the 2013 episode that sent oil and gold into a decent selloff.

Upon examining the dates a little further, we did notice somewhat of a tie-in. 3 of the dates, 6/25/2009, 9/18/2013 and yesterday fell on the day of, or the day after, an FOMC meeting. It shouldn’t be surprising to anyone at this point that the Fed may attempt to assuage the markets with their policy actions, statements or press conferences. But do these “Everything Is Awesome” FOMC days have a lasting effect on the markets beyond the 1-day combined rally? From just a cursory glance, no.

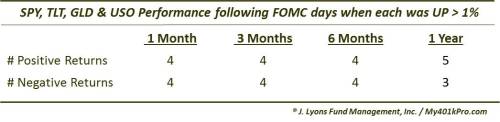

Looking at the returns of the SPY, TLT, GLD and USO over various durations following the prior examples on FOMC days, we see mixed performance from the sectors.

Yes, it is only a sample size of 2, and yes there are unique circumstances surrounding each FOMC meeting. But as one can see, the forward returns after that day have been about perfectly mixed. And while stocks did well after the 2 meetings and oil did poorly, I don’t think we can extrapolate those precedents into the future. The point is, not all of the asset classes furthered their good performance from that day. In other words, don’t assume “everything is awesome” beyond that one day.

Perhaps, the lesson is simply to expect more volatility around FOMC meetings, if one hadn’t picked up on that already. Specifically, expect more positive volatility. This is likely to be truer and truer the more that the focus is on the specific verbiage dispensed by the Fed. With that being the case, one can likely rely on the Fed consistently telling the market that “everything is awesome”, even when that means telling us that not everything is awesome.

________

“Hard Hat Emmet Brickowski” photo by Trev Grant.

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.