What The Record Plunge In The Euro Means For Investors

The news coverage of the weakness in the Euro has been incessant. It has been completely justified, however, considering the currency’s plunge has been equally incessant. But what implications does the move have on one’s investments? Are the news headlines simply trivial noise to ignore or is there a real impact on investors as a result of the Euro’s drop? From the perspective of a U.S. equity investor, it has a material impact and we will illustrate it below.

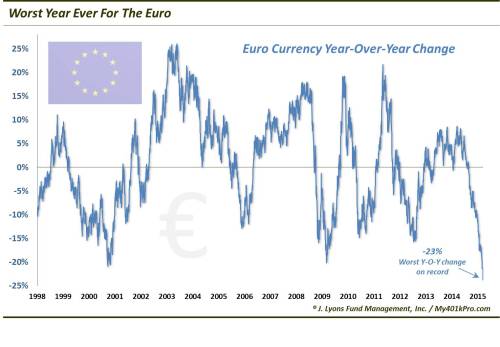

First, however, let’s look at the magnitude of the Euro’s decline. The headline refers to the Euro’s “Record Plunge”. So what makes the plunge record-setting? Today happens to be the 1-year anniversary of the Euro’s high close over the past 3.5 years. A look at its return since then reveals the worst year-over-year performance in the history of the currency going back to 1997.

Over the past few days, the year-over-year return in the Euro has registered -23%. This surpasses the previously worst 12-month returns set in 2000 at -21% and 2009 at -20%. Needless to say, the ubiquitous “weak Euro” headlines have been warranted. (As a word of caution, this record weakness does not imply anything regarding the Euro’s future performance. Indeed, 8-10 months following the previous low Y-O-Y readings, the Euro was higher by 10%-20%).

What does the Euro weakness mean for investors? It obviously has a profound impact on all sorts of asset classes all around the globe. We will present an example for U.S. investors below, however the concept applies to any investments effected by currency moves.

For U.S. equity investors, the most common and easiest way of gaining exposure to European stocks is through U.S.-based mutual funds and ETF’s. While these funds are invested in European companies, the investments are denominated in U.S. Dollars. That means that one’s European investments are impacted by the exchange rate between U.S. Dollars and the Euro. Basically, the return generated by a U.S. investor’s investments in European equities needs to offset by the return in the U.S. Dollar versus the Euro over the same period.

For example, if the European stocks rise 10% but the Dollar also rises by 10% over that same time, the Dollar strength completely cancels out the equity gains. On the other hand, if the Dollar weakens by 10% during that time, it would result in a net 20% gain on the European stock investment. (This is only meant as a crude example of the impact of currency moves on a fund. There are obviously many factors that determine the returns of a specific fund.)

How about a real-life example. This is one that may actually have impacted some readers over the past year. Let’s look at the performance of 2 U.S.-based European equity ETF’s: the SPDR EURO STOXX 50 ETF (Ticker, FEZ) and the WisdomTree Europe Hedged Equity ETF (Ticker, HEDJ). The HEDJ invests in European equities but hedges its exposure to the Euro currency. That is, it sells short exposure to the Euro currency so that it offsets any weakness in the Euro/strength in the Dollar. On the other hand, however, its returns would be similarly negatively impacted by a rise in the Euro currency. The FEZ on the other hand, is not hedged against currency moves. Therefore, any strength in the Euro will aid its return on its European equity investments and any Euro weakness will hurt it. Needless to say, the Euro’s weakness has hurt the FEZ over the past year.

Here is the performance comparison between the Euro-hedged HEDJ and the unhedged FEZ over the past year.

The HEDJ has gained over 22% over the past year, in line with many of the European stock averages. Meanwhile, the FEZ is actually down by 9% in the past 12 months. Considering the record 12-month decline in the Euro, you can figure out the main culprit here: the Euro currency risk.

This example is meant to be illustrative only. It is NOT a recommendation for or against any investment vehicle, product or methodology. It simply shows an example of the impact that the Euro weakness has had for U.S. investors.

If one wants international exposure, this complicates things a little since the currency exposure is another variable to consider. So how does one approach this task? Well, if they have a forecast for where they think a currency is going to go, that can direct them to the appropriate investment, i.e., hedged or unhedged. How do we tackle the currency effect when selecting investments in our management business? It’s simple: we don’t. We endeavor to identify and invest in the sectors showing relative strength at any given time. That is, we try to invest in what is working at the moment. And if the impact of a currency’s move is helping or hurting a particular fund, it will be reflected in the fund’s price. And that’s all that we really care about. It’s difficult enough to make one accurate forecast let alone two. Therefore, we prefer to let prices tell us what is actually occurring.

The record 12-month drop in the Euro currency has righfully garnered lots of attention in the media. For U.S. investors, this weakness, or any currency moves, can have a material impact on international investments. Therefore, it pays to at least know what type of currency exposure a particular investment is subject to if one is considering putting money into it. A prime illustration is the negative impact that the Euro weakness has had over the past 12 months on unhedged European funds located in the U.S.

While that may not help investors with their investment selection going forward, hopefully it provides a little insight into the impact that currency moves can have on their investments.

_____________

Photo by iStockphoto.

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.