Is the British Pound the Next Currency to Collapse?

It’s no secret that the underlying story behind the recent and ongoing historic chapter in financial markets has been global central bank monetary policy. That includes massive quantitative easing, extraordinarily low interest rates (i.e., ZIRP or even NIRP) and the global race by many central banks to debase their local currency. This has resulted in epic drops in the Yen, Euro and a multitude of emerging market currencies. And while the British Pound has certainly come under its share of pressure, the significance of its decline has not met the depths of the others. That could change quickly if the Pound cannot hold important support levels nearby that it is now approaching. And we mean important as in 30-year important.

The History

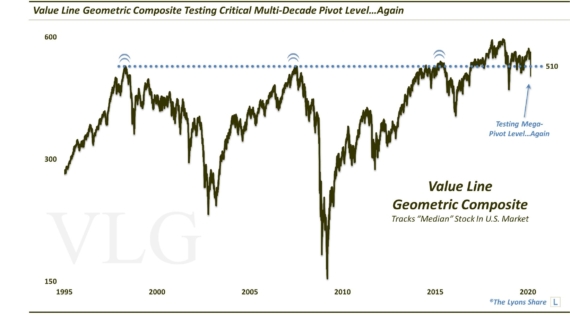

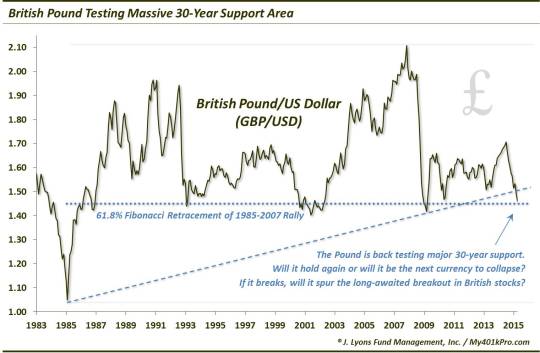

The British Bound bottomed in 1985 at 1.05 versus the U.S. Dollar. After a quick snap back rally above 1.40, the currency traded in a range between the 1.40′s and 1.90′s over the subsequent 20 years. The 1.40′s served as important support on multiple occasions in the mid-1990′s and early 2000′s. In 2007, the Pound briefly topped 2.00 before immediately failing and plummeting back down to the 1.40′s again during the financial crisis. Since then, it has been range bound, reaching as high as the 1.70′s last July.

The Level

With the historic rally in the Dollar since that time, the Pound has suffered along with the rest of the global currency world. In the process, the currency’s decline has now brought it right back down into the critical 1.40′s again. The interesting thing is that based on the rally from the 1985 low to the 2007 high, the all-important 61.8% Fibonacci Retracement level lies at the 1.45 area. Of course in 2001 and 2009, the Pound got as low as 1.40-1.41 so that is perhaps the most critical level to watch. However, we are keeping our eye on the 1.45 area as well. And it just so happens that the low this morning on the Pound was 1.4588 versus the Dollar.

Hold or Fold?

What is the likely result of the test of this area? Well, given that it has held as support for 30 years now, it will not fail easily. If it does, it is likely bombs away, barring an immediate reversal. Therefore, we would expect at least some attempt at stabilization in the 140′s, or even a decent counter-trend bounce. On the other hand, the selloff since last July has been so momentous that it too will not likely die easily. Thus, after whatever potential bounce or stabilization efforts occur, look for the area to come under attack again.

Fuel

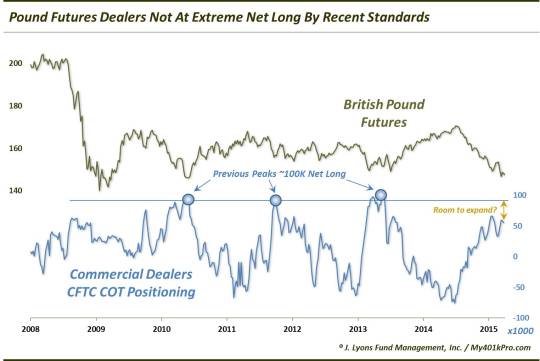

One wild card that could factor into the Pound’s fate at the 140′s level might be found in the futures market. We’ve discussed the Commitment Of Traders report on several occasions in the past. This report published by the CFTC lists the net positioning in futures contracts on the part of various groups. One of the groups is “Commercial Dealers”. These are institutions that typically use futures positions as hedges, in contrast to Non-Commercial Speculators (e.g., commodity pools, hedge funds, etc.) who typically position themselves in attempt to profit from the prevailing trends.

Historically, the Commercial Dealers are appropriately positioned at major turning points in a contract. That is, they are extremely long at bottoms and short at tops. Recently, we’ve seen Dealers in the Euro and Yen contracts reach record net long positions. Currently, while Dealers are very long Pound futures by historic standards, they are less long than they’ve been at lows over the past 5 years. Therefore, it would not at all be surprising to see the Dealers’ net long position expand significantly before a bottom is in place. That scenario may call for a break of the 140′s level.

Policy

The ultimate wild card in the market is monetary policy. Given that the UK economy has held up reasonably well in recent years, at least in comparison to most other places around the globe, monetary policy has not been quite as loose there. Thus, should the economy worsen, the Bank of England would appear to have more arrows left in its monetary quiver in loosening policy than most central banks at this point. Or for that matter, should the BoE wish to lob some volleys into the global currency war for whatever reason, they are better postioned at this point to attempt to weaken their currency. This considerable, shall we say inorganic x-factor could likely easily drop the pound down below the key 140′s level.

Equity Market

Lastly, we would be remiss if we didn’t mention the potential effect of the Pound’s movement on the equity market in the UK. While stock markets around the globe have been furiously breaking out over the past few years, one market conspicuously absent from that trend has been the UK’s FTSE-100. While it has recently topped 7000 for the first time ever, it hasn’t experienced the explosive breakout that we’ve seen in the U.S. and more recently in Asia and elsewhere across Europe. While we may not be thrilled with the “cause” of such a potential breakout, should the Pound drop below the 140′s level, it certainly could provide the springboard for an explosive breakout in the FTSE like we’ve seen elsewhere.

As you can see, the 140′s area is a colossally important level in the British Pound. Given its inability to break that area for 30 years, it will not fail there easily. However, given factors involved related to its price momentum, futures positioning and policy flexibility, an eventual break of the 140′s level would not be a surprise. British equities could be a major beneficiary in such a scenario.

________

“Visiting the UK” photo by Dan Tentler.

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.