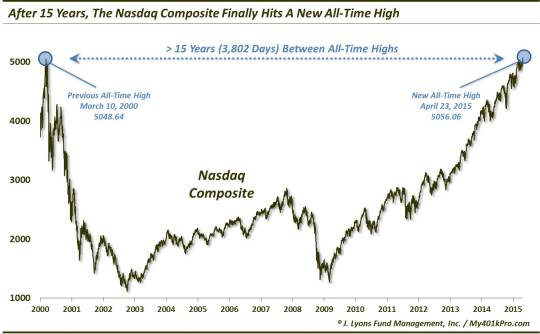

U.S. Stocks Do Something They Haven’t Done In 60 Years

If you are reading this, you are most likely aware of the milestone achieved by the Nasdaq Composite today. After more than 15 long years, the index finally eclipsed its former all-time high set on March 10, 2000. For those keeping score at home, that equates to exactly 3,802 days in between all-time highs.

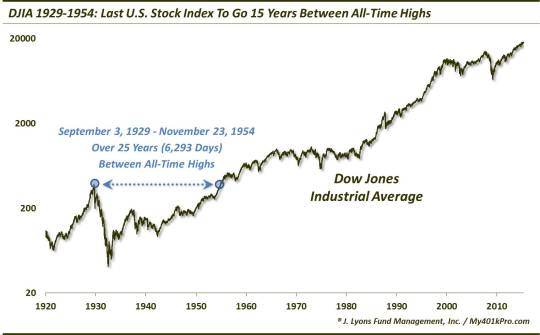

Needless to say, 15 years is a long time between all-time highs. Even during secular bear markets, it’s not unusual for indices to make at least marginal, if temporary, new highs. We have seen a handful of global markets recently end droughts of that length. However, in the U.S., it has been awhile since a major index went so long in between all-time highs – 60 years to be exact.

Based on our observations, the last time a U.S. index scored a new all-time high for the first time in more than 15 years was in 1954 with the Dow Jones Industrial Average (DJIA). For those keeping score at home, that was the year Joe DiMaggio and Marilyn Monroe got hitched. The DJIA had last formed an all-time high at the peak of the 1929 bubble prior to its subsequent crash. The Great Depression and a brutal 20-year secular bear market then ensued. It wasn’t until 1954, 6,293 days later, that the DJIA was finally able to surpass its 1929 high.

We try to make these posts as relevant, useful and “value-additive” as possible. However, this one is more of a trivial nature. We aren’t about to attempt to draw any conclusions or make any real connections between the DJIA’s new high in 1954 and today’s Nasdaq. Although, the similarities are inescapable. Both indices underwent parabolic rises before subsequent collapses. The collapses were followed by stagnant action in the decade+ afterward. However, the differences are stark as well. Most importantly, the 1929-1949 secular bear market corrected the excesses of the preceding bubble in a much more satisfactory fashion than did the present-day market. But that is a topic for another time.

Given the favorable price action and the apparent rally potential in the Nasdaq 100, continued gains would not be a surprise. However, we wouldn’t necessarily expect the index to run for another 2 years unimpeded as the DJIA did following its 1954 new high. For this particular post, we’ll be content with offering a bit of market trivia along with some historical context. After 15 years, the long-awaited Nasdaq new high deserves at least a mention. I’m sure we’ll get back to some heavy lifting tomorrow.

_____________

“Marilyn Monroe & Joe DiMaggio” photo by Ky.

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.