Dow Divergences Part 1: Transports

Divergences are one of the most oft-cited arguments in calling tops. They are also perhaps the least accurate. That’s because divergences (whereby one index reaches a new high while another fails to do so) both A) occur frequently and B) can persist for lengthy periods of time. For those reasons, we are not huge proponents of sending out alarm bells based solely on divergences. It is true, however, that divergences of some variation inevitably do exist at market tops. That is likely the reason for their popularity – if one can accurately identify and time the meaningful divergences, they can possibly exit the market very near the top. This allure of “nailing” the top can be very enticing, though it is exceedingly difficult to do.

All that said, there are suddenly a number of the major divergences present in the market at this time. At least they are major according to some. Given these conditions, we thought we would take a historical peak at a few of these most popular divergences to see if the warnings implicit in them really have any teeth. Thus, this is likely to be “Divergence Week” here on our blog.

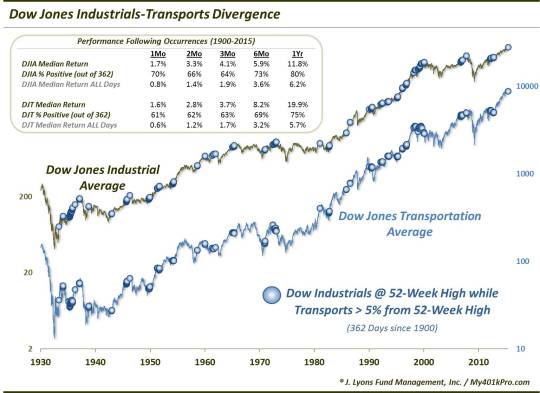

First off is perhaps the most frequently mentioned and longest-standing divergence: that of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJT). This divergence is so popular it has its own name: the Dow Theory. Now there is an entire set of (somewhat ambiguous) criteria surrounding the actual Dow Theory which we will not get into. But its basic premise is that the market is on better footing when both the DJIA and the DJT are confirming moves to new highs. As of today, we have a non-confirmation that may bring alarm bells from the Dow Theorists as the DJIA closed at a 52-week high while the DJT did not.

The aspect of today’s divergence that strikes us is not the lack of a new high by the Transports, but the considerable distance they are away from a new high. That is the subject of today’s Chart Of The Day and study. What, if any, significance is there to the fact that the DJIA is at a high while the DJT is more than 5% away from its 52-week high?

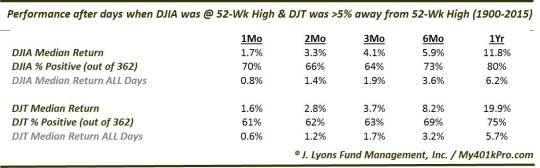

Before today, there had been a total of 362 days going back to 1900 in which the DJIA closed at a 52-week high while the DJT was over 5% away from its own high. Let’s cut right to the numbers and see what has occurred historically following such an ominous sounding situation. From the table on the chart:

It is immediately apparent that negative DJT divergences of this magnitude are not any sort of a death knell for the averages. In fact, the median performance of the Industrials and the Transports were far better than their long-term norm.

One contributing factor to the superb numbers is an abundance of occurrences during massive rallies in the mid-1930′s and mid-1990′s. As mentioned, these types of divergences can persist for awhile and chip away at your portfolio while you wait for their repercussions.

Despite the rosy overall numbers, however, there is some fodder for the Dow Theorists and divergence advocates. As we also mentioned earlier, while not all divergences mark tops, many tops are marked by divergences. So it has been the case with this version. Several major intermediate-term or cyclical tops saw this negative divergence among the Transports, including 1937, 1946, 1961, 1973, 1981, 1998, 2000 and 2007.

In summary, in our first of either a few or a bunch of posts this week on divergences in the market, we looked at perhaps the most famous of all, the Dow Theory’s Industrials vs. Transports. Currently the DJIA is at a 52-week high while the Transports are well off of their own high. But while Dow Theorists may have you running for the hills, the historical track record following similar divergences is less than ominous. That said, on the occasions when this divergence did have teeth, it bit portfolios hard. All in all, we would give the nod to this divergence not being a major concern, although both sides score points.

_____________

“The Splits” photo by Ian Sane.

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.