It May Finally Be Time To Buy Gold…With An Asterisk

It’s been a rough stretch for gold, to say the least. After being the star asset class of the previous decade, the last few years have not been kind to the precious metal, or equities based on it. After running straight up for 10 years, we probably should not be surprised to witness a counter-cycle move. But in the midst, a trend it will very often surprise people by going much further than they expect. So it has been with the downturn in the gold complex. Gold stocks, in particular have gotten hit especially hard. The Gold/Silver Index and the Gold Bug Index actually broke their 2008 lows and are now at 13-year lows. The popular Gold Miners ETF, GDX, just traded at an all-time low since its inception in 2006.

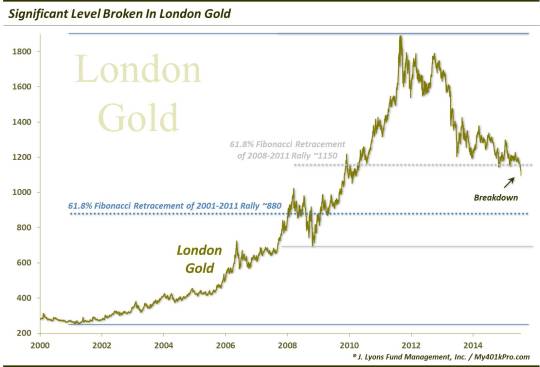

And what about the commodity itself? After nearly 4 years of relentless selling, is it finally time to buy gold? Well, sentiment is certainly about as dour as it gets. That is a plus. So is the fact that the “smart money” commercial hedgers in gold futures are about as net-long as they have been since the gold bull market began in 2001. Those factors are not by themselves catalysts, however. We’ve said before that in terms of buying a “falling knife”, we would only consider it in the event that prices were hitting the most major of support, in our analysis. And in the most commonly quoted price of gold in U.S. Dollar terms, we don’t necessarily see that yet here. In fact, it has recently broken a major line of support, in our view.

Note how the November 2014 and March 2015 lows in London Gold that were just broken over the past week lined up perfectly with the 61.8% Fibonacci Retracement of the rally from the major low in 2008 to the peak in 2011. The break of that low, to us, was significant and opened the door for another wave down. If that area of the breach around 1150 is not immediately recovered, it is vulnerable to further losses, potentially down to the 61.8% Fibonacci Retracement of the rally from the secular low in 2001 to the 2011 high. That would be just below the 900 level, which would obviously represent significant further losses.

If we change our perspective of gold, however, by pricing it in a different currency, things look a little rosier for the metal. For example, when pricing gold in Euro terms, it is hitting a potentially attractive level today. Witness:

You can see the impact that pricing in a different currency can have. For instance, gold/Euros did not hit an all-time high until late 2012, a year after it topped in Dollar terms. After dropping through the end of 2013, it spent 2014 moving sideways (building a base?). Thanks to the blistering that the Euro took last year, gold/Euro never did make a lower low. And in January of this year, gold/Euro exhibited a strong breakout above the potential base of 2014 near 990.

Now, due to the recent gold pummeling, gold/Euros is right back down testing the breakout point, hitting a low today of 981. The other interesting feature of this area is that 981 marks the 61.8% Fibonacci Retracement of the 2013-2015 rally.

Obviously, these are two key levels that may provide a boost for gold priced in Euros, either for the short-term or something more substantial. (If one is interested in such a trade, there are vehicles that price gold in Euro terms. Otherwise, obviously it would entail buying units of gold and shorting units of Euros. Please do your own due diligence and do not take any commentary in this blog as trading or investing advice). Here is a closer look:

This post touches on a number of lessons. For one, if you are going to try to catch a falling knife, golden or otherwise, only attempt to do so at the most major of long-term price support. Secondly, sometimes when a market appears to provide little or no opportunity, perhaps a different perspective can change that. In this case, pricing gold in Euros instead of Dollars puts it at a potentially key support level, as opposed to squarely in the midst of a break down. And lastly, never, ever buy gold…just kidding. After years of pain, gold bugs may finally be getting an attractive opportunity to buy the metal – it just needs to be priced in the right terms.

________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.