Even The Leading Sectors Are Starting To Wear Thin

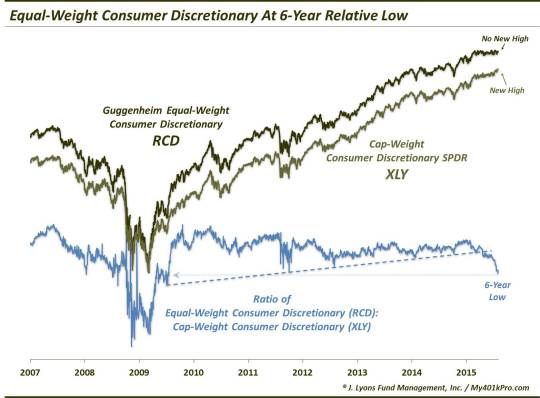

The equal-weight consumer discretionary sector is at a relative 6-year low.

We have been harping on the deteriorating market breadth for months now. Whether it’s fewer advancing issues, fewer new highs, more new lows, less upside volume, etc., the evidence of this internal weakening has been nearly ubiquitous. And while there have been just enough strong market segments to keep the major averages afloat, even the leaders are beginning to show signs of wearing thin.

We mentioned one such “ailing general”, the Nasdaq 100, a few weeks ago (on the day that AAPL got slammed). Now we are beginning to see similar signs in the more focused sector leadership. One example of this is the consumer discretionary sector.

Consumer discretionary has been one of the stars of both the cyclical bull market as well as the recent rally since last October. Just this year, it is up roughly 10%, leading the way along with health care among the major sectors. Looking internally, however, we can see signs of weakening. Case in point: since the beginning of the year, the equal-weight average of the sector (as represented by the Guggenheim Equal-Weight Consumer Discretionary ETF, ticker RCD) has been weakening relative to the cap-weight average (as represented by the Consumer Discretionary SPDR ETF, ticker XLY). Recently, that weakening has been downgraded to a tailspin. Observe the chart:

One can see that the equal weight:cap-weight ratio peaked near the beginning of the year. Despite this, both indexes have continued to rise. That is not necessarily surprising as we often see breadth peak before prices. And the equal-weight average is really a measure of breadth as it accounts for all constituents equally. Thus, if the average is doing well, then the broad array of stocks within the sector are doing well. And conversely, if most stocks are struggling, the average will necessarily struggle too.

With the equal-weight average having peaked versus the cap-weight, we have an indication that all is not as well under the hood of the consumer discretionary sector as the cap-weighted XLY might have one believe. One may argue that it did close at an all-time high just yesterday so how bad could it be? Well, a couple recent development on the chart are concerning to us.

First off, the relative weakness of the equal-weight index has accelerated, beginning with the April break of the post-2009 UP trendline in the RCD:XLY ratio. Since then, the ratio has essentially gone straight down, closing at a 6-year low yesterday. Plus, the trouble is not just confined to the relative basis. On an absolute basis, the equal-weight RCD has failed to make a new high here in August along with the cap-weight XLY. This deserves to be monitored in coming days and weeks as a divergence here would be another red flag.

The bullish stock market argument has centered around the fact that there are still enough leaders in the market to keep it moving forward. This is an agreeable argument – if you own the leaders. If you do not, you may be surprised at what is happening across the broad market spectrum (looking at you Mr. Diversified Equity Portfolio). We have no problem maintaining exposure to the leading segments of the market that continue to roar higher. As we see with the consumer discretionary sector, however, it should be noted that once the relatively few leaders give way (DIS is getting slammed today), there is not much of a foundation underneath supporting this market.

_____________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.