Inverse ETF Hedging Near Record Levels

In recent weeks, we have discussed a number of data points indicating elevated levels of hedging in the equity market. This includes examples from the equity options market, the volatility market as well as evidence from the hedge fund industry. Obviously these factors did not prevent the current correction in stocks from occurring. One of the areas of the market that had seen scant evidence of hedging was in the inverse ETF products (i.e., funds that rise as the market falls). That changed over the past few days, as is customary in sharp selloffs like this. In fact, the degree of interest in these funds has risen to a near record.

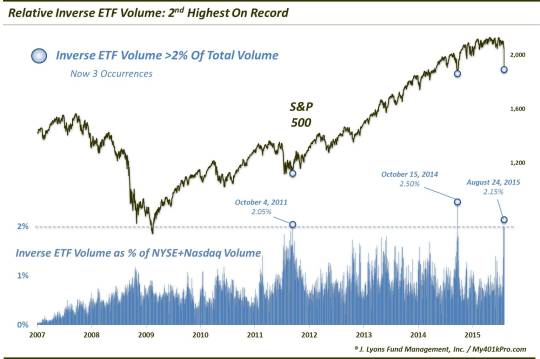

Specifically, the amount of volume traded in a select group of inverse ETF’s that we track, as a percentage of total NYSE+Nasdaq volume, hit the 2nd highest level ever yesterday.

Of course these types of funds are still fairly new, having risen in popularity in just the past 7 years. Therefore, there isn’t a lot of history with which to make comparisons. However, yesterday’s 2.15% of total exchange volume that occurred in inverse ETF’s trailed only October 15 of last year (2.50%). In fact, the only other day registering over 2% was October 4, 2011. Now, these are just two precedents. However, they each marked the precise end of intermediate-term declines.

Yesterday, we looked at the extreme skew in breadth statistics occurring on the day. Such overwhelmingly negative readings have very often signified washout days. This rush into inverse ETF’s was another sign of a potential washout. Like we mentioned yesterday, these events have very often come at, or within days, of at least an initial, short-term low.

Thus, given the evidence, a bounce *should* occur within a day or two. Of course, to take that statement as a downgrade in the very short-term risk level would be a dangerous conclusion.

______

“Dark Hedges” photo by Andrew Gibson.

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.