Irish Stocks Hit 7-Year Highs

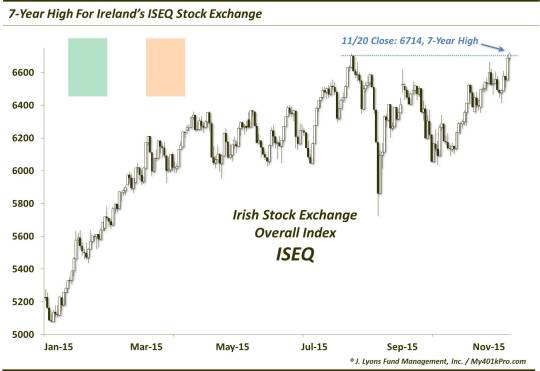

Ireland’s stock market is one of the first to hit new highs following the recent correction.

No, this is not a comment on the college football rankings. It is still a markets-focused blog. This post is a shout-out to the country of Ireland – or at least its stock market. We mentioned in yesterday’s post on the broad European equity market that most markets across the continent looked similar, i.e., approaching resistance as they struggle to claw back following the August-September rout. Ireland is an exception, however, as evidenced by its ISEQ Stock Exchange Overall Index closing at a 7-year high today.

Now, assuming you have access to these Irish stocks and the potential to participate in the rally, there is perhaps one little caveat before getting too gung-ho bullish. One of the most important levels of resistance (or support) in our experience, is the 61.8% Fibonacci Retracement from a major high to a major low (or low to high).

In the case of the ISEQ, the index hit its all-time high in 2007 near 10,000. In the subsequent 2 years, the index sold off by more than 80%, bottoming below 2000 in 2009. The 61.8% Fibonacci Retracement of that decline is around 6900. The ISEQ closed today at 6714. Thus, while the new high is a positive – especially with most other averages well below their highs – the immediate upside may be somewhat limited (you may recall, in a St. Patrick’s Day post earlier this year, we targeted this area around 7000 as a level of potential resistance),

As you can see on the longer-term chart, the next most important Fibonacci Retracement level, 38.2%, was successful at halting the ISEQ’s post-2009 rally for about 10 months in 2014. We would expect the same may occur near the vicinity of the 61.8% level around 6900.

Lastly, as we mentioned, the Irish stock market bears little resemblance, in the short-term, to most of the markets in Europe. Likewise, it bears little resemblance to its fellow, so-called, “PIIGS” in the longer-term. Countries like Greece and Portugal are much closer to 7-year lows than highs at this point. So what accounts for Ireland’s separation from its fellow PIIGS? As we stated in the St. Patrick’s Day post:

Many economists will point to the country’s aggressive austerity-driven approach to its economic reforms. While we are not economists, and don’t strive to be, we personally are sympathetic to such arguments and applaud such a commitment by the country. And though the nature of Ireland’s economic woes was somewhat different than the other PIIGS, their approach to reform should at least garner some consideration among other debt-burdened, economically-challenged countries.

Whatever the cause for Ireland’s out-performance, economically or stock market-wise, the country deserves a tip of the cap…or the pint, if so inclined.

________________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.