Key Manufacturing Industry Crumbles To Post-Crisis Lows

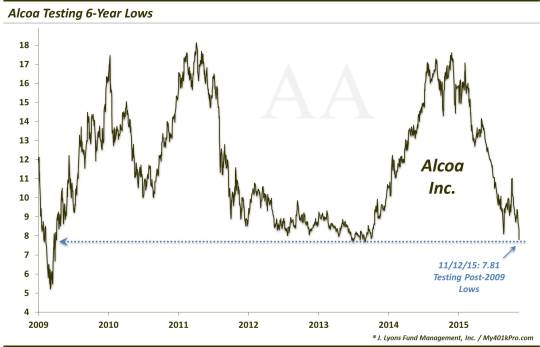

Aluminum stocks are hitting their lowest levels since 2009.

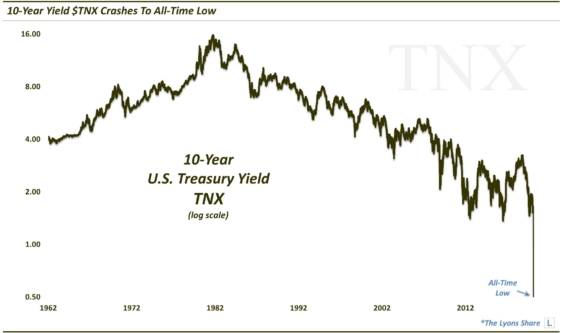

The past few weeks have brought a resurgence of the deflation theme. All matters of commodities and their associated equities have, to varying degrees, resumed the selling pressure that has characterized much of the past 18 months. The aluminum industry is no exception. In fact, using the Dow Jones U.S. Aluminum Index as a gauge, aluminum stocks closed today at their lowest levels since April 2009.

To be sure, the index is dominated by its largest component, Alcoa. Alcoa, of course, is widely known for its distinction as the first major U.S. company to report earnings each quarter (isn’t it time to think about juggling that lineup around?) The similarity of the charts is unmistakable. However, the weakness is not just due to Alcoa. Notice that, even with today’s drop, Alcoa is slightly holding above its 2013 levels.

The concern with the degree of weakness seen in this industry in particular is its ties to both the manufacturing scene and the labor market. Yes, we have seen some examples of solid metrics in those areas. However, aluminum is said to be a $150 billion industry and directly or indirectly responsible for 670,000 jobs in the U.S. It is tough to imagine that things are that robust given what is happening in the aluminum market, not to mention other resource markets.

We’re not suggesting that those rosy economic numbers are bogus. Just consider us objective skeptics…minus the tin foil hats.

________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.