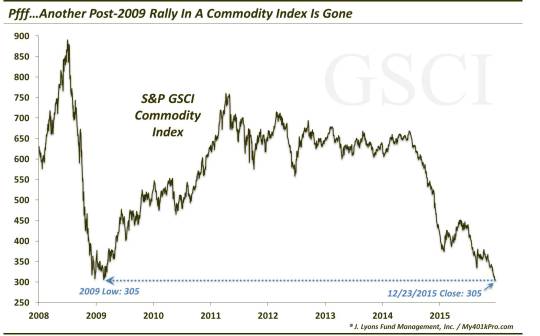

Another Major Commodity Index Drops To 2009 Lows

Like the CRB before it, the S&P GSCI Index has dropped all the way back to its 2009 lows; will it find support there?

Another index bites the dust of the deflationary spiral. On August 3, we noted that the popular Reuters/Jefferies Commodity Research Bureau Index (CRB) had reached a dubious milestone. The index had gotten bludgeoned so badly that it had lost its entire roughly 85% gain following its 2009 low. Well, it took another 4+ months, but it has now been joined in that distinction by another major commodity index, the S&P GSCI index (GSCI). The GSCI made a low in 2009 at 305. It closed yesterday at 305.013.

What do we do with this information? Probably nothing, to be honest. It’s likely more of a trivial tidbit than anything else. Sure, it is quite likely that, looking out several months to a few years, the index has a good shot to be higher than it is now. That is merely a comment on its “oversold” condition, however.

As for the potential of this area to provide some sort of support, we’re not going to make that reach. The CRB kept slicing right through its 2009 low once it reached it. One factor that may potentially give the GSCI a better shot at finding support at its prior lows is the fact that more money is tied to this index. That is, more funds, etc. track the GSCI than the CRB. Thus, if there is a technical case to be made for support coming in at the 2009 lows, it is stronger for the GSCI than it was for the CRB.

Outside of that long shot, finding a commodity bottom continues to be about as difficult as finding Keyser Soze.

_____________

Kevin Spacey as Keyser Soze from “Usual Suspects” video viahttps://www.youtube.com/watch?v=V1tmkAFb_Os

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.