Good News: Gold Speculators Haven’t Been This Gloomy In 13 Years

Gold sentiment may finally be getting bearish enough to support a durable bottom.

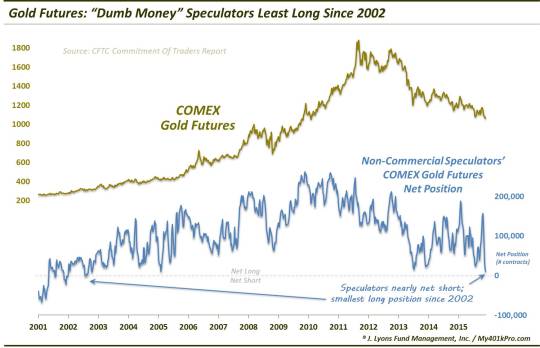

Gold bugs may finally be getting the good news they’ve been waiting for: gold Speculators haven’t been as pessimistic as they are now since 2002. True, the best news for gold bugs would be rising gold prices. However, to establish the conditions capable of supporting rising gold prices, investor sentiment towards the metal needs to first become exceedingly pessimistic. If that sounds backward to you, that’s how markets work.

For the read on sentiment, we are using the CFTC’s Commitment Of Traders (COT) Report. To refresh, the CFTC tracks the net positioning of various groups of traders in the futures market in the COT report. One such group is called Commercial Hedgers. As their name implies, their main function in the futures market is to hedge. On the other side of the ledger – and normally with a mirror image position – is the Non-Commercial Speculator group. These Speculators are typically funds engaged in, you guessed it, speculating.

Speculators’ positions tend to follow prices while Hedgers’ positions generally move in the opposite direction. During an extended price trend, Speculators may fare well as they will likely be positioned consistent with the trend. On the other hand, it is almost always the case that Speculators will be incorrectly positioned – and to an extreme – at major turning points in a market. And while the moniker may not be fair, it is for this reason that the Speculator group is most often considered “dumb money”.

One group that hopes that moniker carries some weight is the gold bug community. That’s because Non-Commercial Speculators in gold futures are the least net long that they have been in 13 years.

As the chart shows, as of December 1, Speculators have not been this close to going net short since late 2002 when the gold bull market was just getting started. On the other side, Commercial Hedgers have not been this close to net long since that same time. They are slightly less short than the last time we pointed out such an extreme, in early August. Following that reading, gold proceeded to rally about $100 over the next couple months.

Gold could not sustain those higher prices, however, and have since dropped below those summer lows. That outcome is consistent with the more contemporary behavior of this data as it seems to be more volatile and quicker in moving from one extreme to the other. This is quite likely owed to the rise in popularity of commodity-based ETF’s that access the futures markets. The result has been that the impact on prices of the extremes in positioning has been more abrupt and less durable than in the past.

Another challenge in applying this analysis is that it is difficult to correctly determine when an “extreme” in positioning will actually result in a price reversal. As is said regarding all sorts of market metrics, an extreme in COT positioning can always get more extreme. Thus, while the Speculators’ lowest net long position in 13 years should and likely will be a bullish factor at some point, it’s possible that that point won’t appear before even more pain occurs in the gold market and the positioning gets even more extreme.

It won’t take much more selling pressure to push Speculators into a net short position and Hedgers into a net long position for the first time since the onset of the gold bull market. And while markets don’t typically conform to a tidy narrative such as that marking the bottom for gold, it would certainly be a welcomed development for gold bugs.

At a minimum, as we said in the August post, what has mostly been a headwind for gold for the past decade or so is no longer the case. While it may not make an immediate impact, “dumb money” Speculators are now more pessimistic toward the metal than at any point since early in the bull market, 13 years ago. Gold bugs should be optimistic about such pessimism.

_______________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.