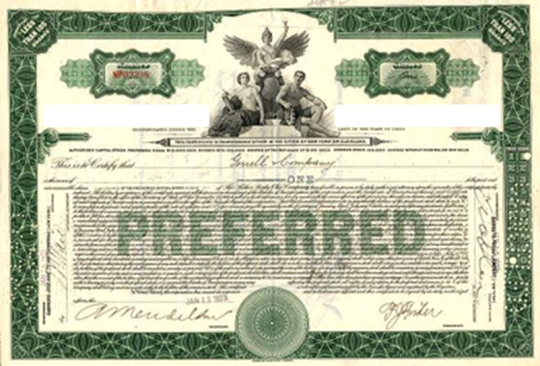

In Investing, Counter-intuitive Is The “Preferred” Way

Contrary to the prevailing wisdom, preferred stocks have excelled since the Fed’s rate hike.

While listed as stocks, “preferred” shares are a hybrid between stocks and bonds. They provide a fixed dividend that takes priority over payouts on common stock. At the same time, they are highly sensitive to interest rates like bonds, i.e., as rates rise, prices generally fall, and vice versa. As such, the conventional thinking approaching the likely Fed rate hike in mid-December was that preferred stocks would suffer along with other higher yielding instruments that serve as competition for low-rate fixed income securities. Indeed, in the days leading up to the Fed meeting, preferred stocks sold off sharply as an impending rate hike became more apparent.

Then a funny thing happened. After the rate hike occurred, preferred stocks began to rally. And the development has even gone somewhat beyond the “sell the rumor, buy the news” stage at this point. Judging by at least one popular preferred stock ETF, the PowerShares Financial Preferred ETF (PGF), preferred stocks have actually moved to new 52-week highs. And bear in mind that this does not even adjust for PGF’s hefty 5.63% yield.

So what is the deal here? Why is this scenario not unfolding along conventional wisdom? Well, for one, financial companies do stand to benefit in some ways from rising interest rates. Therefore, perhaps that fact is countering the ill-effects of the rate hike on the competitiveness of preferred stocks’ yields. Further, while the Fed did hike the short-term Fed Funds rate, the jury is still clearly out on a rising longer-term rate environment. If longer-term rates remain subdued, the attractiveness of securities like preferred stocks could persist.

Regardless of the underlying fundamental “reason” that preferred stocks have jumped in the wake of the Fed rate hike, here is the real reason as we see it: it was the least obvious, most counter-intuitive reaction. As the old market bromide goes, “if it’s obvious, it’s obviously wrong.” And as unsatisfying an explanation as that may be for most people, it is an utterly reasonable and adequate explanation to us.

This touches on the very core of the investment process, which is determined by human natural reactions. And, at least in the investment world, human nature will invariably dictate that one do the wrong thing at the wrong time. So while we don’t know if preferred stocks will continue to do well going forward, we do know one thing.

In investing, when faced with going the obvious route or the counter-intuitive route, counter-intuitive is the “preferred” way for us.

________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.