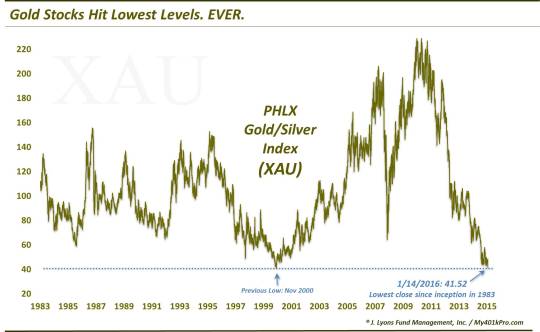

Gold Stocks Hit Lowest Levels. Ever.

A popular gold equity index closed at the lowest level in its 30-year history today.

It has been a rough ride for gold bugs in recent years. We have written about gold’s slide on numerous occasions. An even sadder tale, though, has been that of equities whose business is based on the precious metal. Gold stocks have been mercilessly beaten down since their top in late 2010. In 5 years, these shares have lost over 80% of their value, based on the oldest gauge of the sector, the PHLX Gold/Silver Index, or XAU. In particular over the past year, we have documented milestone after dubious milestone on the part of gold stocks. Today’s “achievement” takes the cake, however. The XAU closed today at 41.52. Since its inception in 1983, that is the lowest close ever in this index.

Now, this is not a piece aimed at kicking gold bugs when they are down. Markets are tough and any ill-intentioned sentiments are out of line (not to mention, hecklers are sure to be humbled, themselves, at some point in this “game”.) There is a lesson here, though.

As a money management firm, our investment philosophy at JLFMI has always centered around actively managing risk. This includes our investment selection. The sectors, assets, etc. in which we choose to invest are determined by a quantitative model designed to detect areas of relative strength. That is, we want to be in areas that are going up, and faster than the rest of the market. Furthermore, when that relative strength fades, we want to be disciplined enough to get out of those areas and move on to something else.

Now, in our history, there has been one exception (that I can recall) to this philosophy. In 2010, we decided to take a small “core” position in gold (the metal, not the equities). We sympathized with the longer-term bullish thesis for the precious metal (and still do). For awhile, it was working out well. Then the trend began to turn south. In 2013, the bullish trend was decidedly broken. Yet, we continued to maintain at least part of this core position. Mistake.

Last year, we finally jettisoned the last portion of the gold position. Not because the thesis had changed, but because the trend had. And it had changed long before. But for the first time in our history, we ignored the truth that is price. Everything cycles up and down and, indeed, that is at the core of our investment philosophy. But for fear of missing out on the “big one” or being without the black swan hedge, we ignored that for awhile.

So we do sympathize with gold bugs and their longer-term thesis, but we also (re)learned a valuable lesson. The point of an actively-managed strategy is that, should the “big one” hit, we will be there to catch it, because the asset will be going up. And just as importantly, when the trend turns down, the strategy is there to protect us from remaining invested – especially in assets hitting all-time lows.

________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.