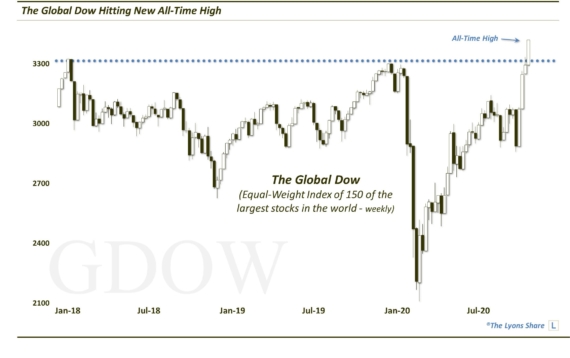

Key Global Equity Index Takes Elevator Down To Support

After breaking key support on January 6, the Global Dow Index has straight-lined down 10% to our next projected support level.

In a January 6 post, we outlined why we felt that day marked a key juncture in the markets. The significance related to a plethora of breakdowns below major support levels among various key indices. One of those indices was the Global Dow Index, an unweighted average of 150 of the world’s largest companies. That day marked a breakdown below the 2280 support level that had held the index in August, September (after a false breakdown) and December. We highlighted roughly the 2060 area as the next potential significant support, a level that would mark a further 10% drop in the index.

Well, like the Value Line Geometric Composite that we covered on Wednesday, the Global Dow followed the old Wall Street adage about bull markets taking the escalator and bear markets, the elevator. In fact, it may have simply jumped down the elevator shaft as, in a span of just 10 days, the index found itself already down at that lower support level.

So what now? The risk has been wrung out and back up the escalator we go? Well, not necessarily. In our view, yes, the level is significant enough that it should hold, at least temporarily. In fact as of today’s close, the Global Dow has already jumped some 4% off of Wednesday’s low. The fact that it bounced where it “should” is a good sign that A) we accurately identified the correct potential support area on the chart and B) prices “respected” (i.e., held) at that area.

This is good news for bulls because, despite what seemed like an out-of-control freefall at the time, price movement was at least orderly, albeit swift. In other words, while the elevator was plummeting, at the very least, it stopped at the appropriate floor. This gives us confidence in the validity of the level. Prices could still chop around and test that level again (or even break it temporarily) before any durable bounce. However, this gives us a reliable level to “play off of, up or down.

Now, about that rate of descent. Does it make a difference, in terms of the support level’s likelihood of holding, that the Global Dow hit the lower target so quickly? We think it does. Unless the index rallies back above the previous support level, and does so about as quickly as it dropped, the swift decline is probably bad news in the longer-term. While anything is possible, we feel the “V-Bottom” days are behind us so this scenario is unlikely.

Therefore, given the swiftness of the drop to current support, the index is unlikely done with the area yet. An intermeidate-term bounce (i.e., weeks-months) could very well be initiated from this level, however, prices are likely to test the level again prior to any durable intermediate-term bounce. Furthermore, such downside momentum could suggest that subsequent to any intermediate-term bounce, this level may very well break eventually. That threat is especially relevant given our longer-term, less-than-optimistic expectations for the stock market, in general.

This is all speculation at this point. However, given that the index has conformed very closely to the technical, charting analysis that we have applied over the past 10 months or so, the speculation should be given due consideration.

So the good news for bulls is that, despite a painful elevator ride down, the Global Dow did bounce where it should have. Thus, a tradble intermediate-term rally is quite possible. The bad news is that the speed of the descent suggests that prices are unlikely finished testing this area in the short run – and likely to threaten the area again in the long run.

_____________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.