UPDATE>>Just 2 Weeks After Breakdown, Key Index Hits Ground Floor

Just 2 weeks ago, we surmised that the breakdown in a key broad market index opened up an additional 12% of downside risk; that risk has already been realized.

The saying goes that bull markets ride the escalator and bear markets, the elevator. This, of course, refers to the tendency of stock prices to decline more rapidly than they advance. Unlike many Wall Street adages, this one has more than a modicum of truth to it. And in a veritable selling panic, the elevator will even skip most of the floors on its way to the destination. This has been the case following one of our recent posts.

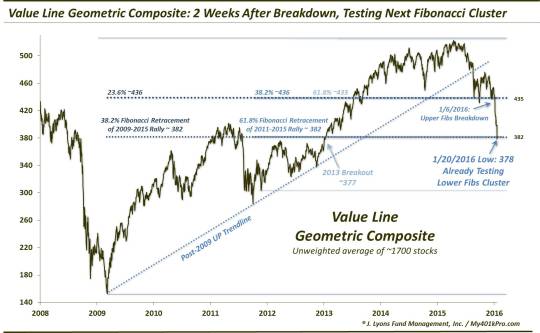

On January 6, we wrote a post titled “BREAKING!: The Bull Market?”. In our view, January 6 marked a key juncture in the equity market as we outlined in the post. On that day, various indices broke what we determined to be major levels of support pertaining to the bull market. Perhaps most importantly was the Value Line Geometric Composite.

As noted many times here, the Value Line Geometric Composite (VLG) is an equal-weight index comprised of approximately 1700 stocks. It essentially tracks the median stock move in the market. As such, in our view, it provides the best assessment of the health of the broad U.S. stock market.

Having broken the post-2009 Up trendline in the August decline, the VLG was reliant on a cluster of Fibonacci Retracement levels near the 435 level for support. These included:

- The 23.6% Fibonacci Retracement of 2009-2015 Rally ~436

-

The 38.2% Fibonacci Retracement of 2011-2015 Rally ~436

-

The 61.8% Fibonacci Retracement of the Rally from the 2013 Breakout to 2015 ~433

This level held successfully in the August decline as well as the September re-test. It also held temporarily in mid-December. However, on January 6, the level was broken. This is what we said about the significance of the break:

What does it mean? Besides opening up potentially 12% of downside to the 382 area, it would signify a lower low on the chart. Lower highs and lower lows would signify a downtrend for the majority of stocks, threatening the extinction of the post-2009 bull market.

Well, we felt pretty confident about our read on the situation at the time and figured the additional 12% drop to 382 would probably become a reality in the not-too-distant future. We frankly did not expect the VLG elevator to express to that destination in just 2 week’s time as it did, dropping to an intraday low of 378 today.

So what now? We still view this level around 382 as a significant level based on the subsequent lower cluster of Fibonacci Retracements:

- The 38.2% Fibonacci Retracement of 2009-2015 Rally ~436

- The 61.8% Fibonacci Retracement of 2011-2015 Rally ~436

- The 2013 Breakout level ~433

Although many indices have been slicing right through “should-be” key support levels, we would still expect the VLG to offer some attempt at holding this level, notwithstanding a possible temporary overshoot. Particularly given the speed of the VLG’s descent, there will quite possibly be some choppiness and testing of this area before a substantial rebound materializes. However, there are signs of panic/capitulation that are also starting to pop up, at least on a near-term basis, that could support some kind of a bounce.

So on an intermediate-term basis, much of the potential downside risk that we have been warning of has been wrung out of the market. However, our longer-term concerns have not been ameliorated. In fact, the price breakdowns among the indices has cemented our pessimistic longer-term view as the bullet-proof, relentless-bid market of the past few years has finally been stymied.

Thus, ultimately the VLG could visit the 338 and 294 levels as its next destinations sometime down the road. For now, however, until proven otherwise, the elevator may have temporarily hit the ground floor.

________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.