FX: Cable Gets Pounded

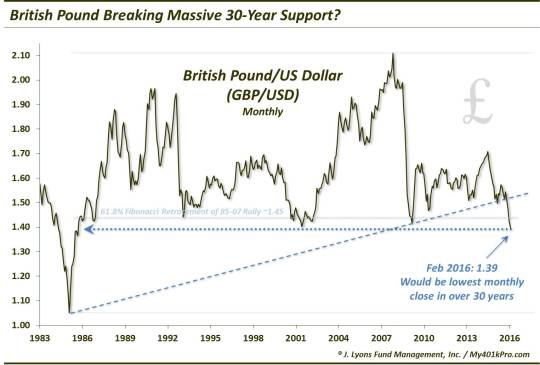

The British Pound is plumbing 30-year lows versus the U.S. Dollar.

The central banks’ global game of debase your currency remains alive and well. In fact, in some ways, it is the only game in town. That bodes very poorly for the global economy and equity markets as good old-fashioned organic economic growth is hard to come by these days (non-partisan economists and historians will look back at this epic experiment with bewilderment…but I digress). The latest player to take center stage in this game? The United Kingdom. Owing ostensibly to “Brexit” talk the price of the British Pound versus the U.S. Dollar – aka, “cable” – has dropped to near 30-year lows.

Trading at 1.39 currently, should the GBP/USD close here in 2 days, it will be the lowest monthly close since September 1985 –notably breaking the lows near 1.40 from 1986, 1993, 2000-2002 and 2009. A solid break below 1.40 opens up the all-time lows around 1.05, eventually.

Who saw this one coming? Well, since you asked, we did. At least we suggested it in a post last April titled “Is the British Pound the Next Currency to Collapse?”. Yes, that was 10 months ago, but the cable was in the midst of a 9-month selloff and due for a breather. It was also hitting the colossal 30-year support area near 1.40. Thus, we concluded that:

As you can see, the 140′s area is a colossally important level in the British Pound. Given its inability to break that area for 30 years, it will not fail there easily. However, given factors involved related to its price momentum, futures positioning and policy flexibility, an eventual break of the 140′s level would not be a surprise.

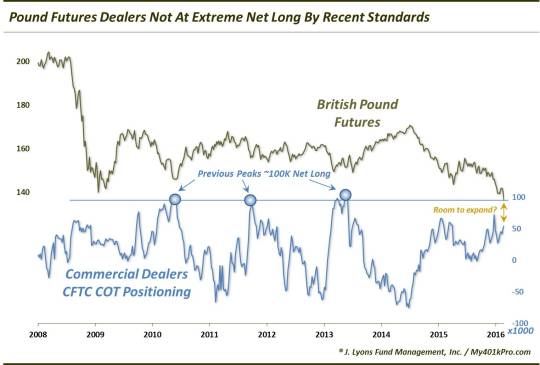

Regarding the futures positioning, our point was that, despite the extreme lows in Pound futures at the time, Commercial Dealers’ net long positioning was still well below that at prior lows in the contract. This group is typically correctly positioned at major turns in futures contracts. Our thought was that the Dealers’ net long position had room to expand still, and could accommodate a further drop in the Pound. That did not transpire. However, the Dealers’ positioning right now is in a similar spot as it was last spring (at least as of last week). Thus, their net long position would appear to have room to expand should the Pound look as if it might suffer this momentous breakdown.

In terms of policy (and we do not want to stray too far down this tangent), it would appear that the Bank Of England has much more ammo, arrows, tools, etc. at its disposal than most central banks should it want to “persuade” the Pound lower still. At least, it has not fired off its version of currency “shock and awe” yet. Thus, perhaps the central bank has some credibility on its side (which by the way is perhaps the weakest “currency” of all among global central banks).

Whatever happens (e.g., Brexit, debasement, etc.) the cable is experiencing a potentially massive breakdown at this juncture, making it the current MVP of the global currency wars.

________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.