Will Latin American Stocks Finally Find Support At This Key Level?

This beleaguered Latin American index is testing the 2008 lows.

Stocks around the globe have had a rough start to 2016. For one region, though, this is nothing new. Latin America has been in the midst of a nasty bear market going on 4 years now. The region has represented a perfect storm of negatives, from its emerging market status to its commodity exposure to currency risk. However, by one measure, things may have gotten so bad that it’s due for some good – at least in the short-term. Looking at the S&P Latin America 40 Index (SPLAC), we see that prices have come down to match the lows set in 2008.

What is the

S&P Latin America 40 Index? It is a composite comprised of stocks from the 5 largest equity markets in Latin America: Brazil, Mexico, Chile, Peru and Columbia, with Brazil being the most heavily weighted by far at almost 50%. Obviously we are really squinting to see the glass half full in this case. However, the 2008 lows represent a major juncture on the chart and could spark a bounce near here. The obvious questions is whether any bounce will be a durable one (finally), or merely a dead-cat bounce, or gato muerto.

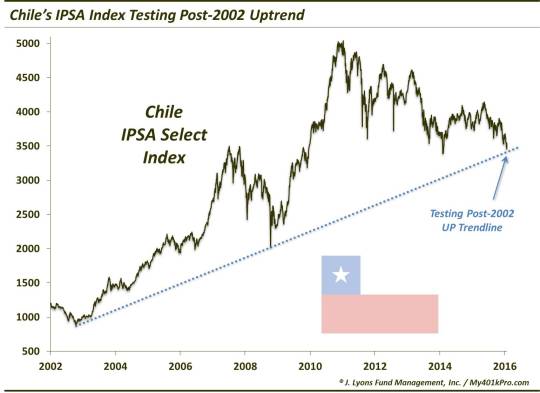

If you follow us on Twitter, (@JLyonsFundMgmt), you may have noticed that we have recently posted potentially positive charts on 3 of the above country markets, Mexico, Chile and Brazil (though, by positive we may mean “not a total disaster).

For one, the Mexican IPC Stock Index recently reclaimed its post-2011 Up trendline that it had broken early this year.

Chile is presently attempting to hold its post-2002 Up trendline.

And even Brazil has been so beaten down that it is hitting the lower boundary of its price channel since 2010, which also corresponds with the 78.6% Fibonacci Retracement of its 2008-2010 rally (by the way, if you’re wondering why the SPLAC looks so much worse than its largest component, Brazil, it is due to currency effects – this SPLAC is priced in U.S. Dollars).

In this market, one may need to be a bit creative to find attractive long opportunities (that’s why, as a firm, we don’t limit ourselves to only “playing” the upside). In a bear market, it is very difficult to make money by buying stocks. In this case, things are so bad they may be good. The 2008 low is a major low that should produce some sort of a bounce, at least in the short-term. Whether it will produce a sustainable bull market remains to be seen.

We will continue to monitor this level on the S&P Latin America 40 Index, though, with the thought that above the 2008 lows is bullish and below is negative. And while some sort of bounce is expected, the possibility of prices slicing right through the “support” level cannot be ruled out considering the type of market we are in. It would not be the first market to do so, as various commodities, currencies and emerging markets have moved to new post-2008 lows – again, the precise factor cocktail representing Latin America.

________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.