Have The Dollar Excesses Been Worked Off Through Time?

While the U.S. Dollar has suffered very little price damage since topping a year ago, “smart money” commercial dealers have unwound much of their record short position.

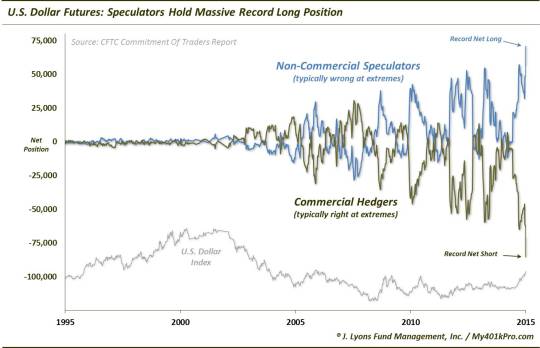

A year ago, the buzz in the financial markets was all about the red hot rally in the U.S. Dollar. Well, that and the oil/commodity bloodbath still underway – which most would concede owed its plight to the Dollar strength anyway. At the time, there were plenty of signs starting to pop up suggesting that the Dollar move was becoming grossly overdone. One such indication came from the CFTC’s Commitment Of Traders (COT) report on U.S. Dollar futures positioning which was flashing an unprecedented sign of excess.

We’ve talked about the COT report on several occasions in the past. To refresh, the report tracks the net positioning of various groups of traders in the futures market. One such group is comprised of Commercial Dealers, or hedgers. As their name implies, their main function in the futures market is to hedge. By definition, therefore, they typically build up positions contrary to the prevailing trend. As a result, this group is typically correctly positioned (and extremely so) at major turning points in a market. It is for that reason that the group is usually referred to as the “smart money”.

At the peak of the Dollar rally last March, Dealers had built up an extreme net short position of more than -100,000 contracts. In fact, it wasn’t just extreme, it was their largest net short position on record. We presented the chart on several occasions last year, illustrating just how extreme the position was. The following chart was posted in January 2015 (the Dealer net short would grow larger into March):

Besides being an aesthetically-pleasing chart (yes, we have chart attachment issues), it is revealing in its presentation of the Dealers’ (Hedgers’) excessive net short position (and, by extension, the Non-Commercial Speculators’ record net long position). While these extremes are historically challenging to time, our conclusion was that “the U.S. Dollar rally could be in danger at some point soon…[and that] while the U.S. Dollar remains in a strong uptrend at the moment, bulls should at least have money management strategies in place in case of a reversal in trend.”

As mentioned, the Dollar rally would extend for another 2 months before stalling. The question then was, in what form would the Dollar’s corrective action take? An uptrend and its associated excesses can take 1 of 2 forms:

- Prices can go down by a significant amount, or

- Prices can go nowhere for a significant amount of time

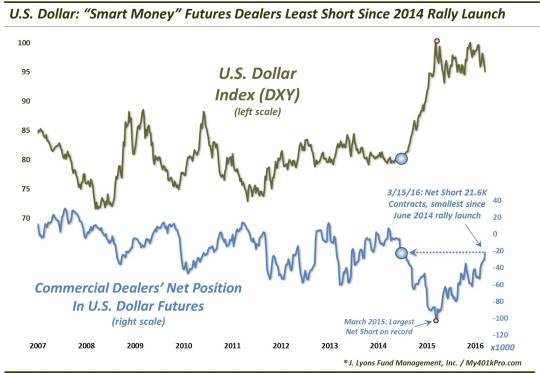

The Dollar correction over the past 12 months has taken the form of the latter option. After topping at around 100 last March, the U.S. Dollar Index (DXY) has moved sideways in a distinct range between 93-100. Even after much-publicized “weakness” over the past few weeks, the DXY stands at 95. Thus, the corrective action has unfolded more through the passage of time than through falling prices.

This type of correction through time is generally considered to be a “continuation” pattern as opposed to a reversal pattern. That is, once the correction runs its course, prices will “continue” again in the direction of the original trend – in this case, up. Of course, this is assuming the various excesses associated with the trend have been “corrected”. In this case, there is indeed evidence that at least the excesses in the futures market have been substantially worked off, despite the minimal price damage.

Witness the updated chart of the Commercial Dealers’ net position in U.S. Dollar futures (we have left off the Speculators’ position which is basically the inverse). While prices have moved essentially sideways, the Dealers’ net short position has dropped to -21,645 contracts.

Significantly, this marks the Dealers’ smallest net short position since June 2014. What is noteworthy about that month? It marked the launch-point of the massive 2014-2015 Dollar rally.

Now, we are not suggesting that the Dollar is geared up for another similar advance. Indeed, Dealers had actually accumulated a net long position shortly prior to the rally. Thus, their position can get less short from here – or net long. That would imply further corrective action in the Dollar, in some form or another.

However, our takeaway here is that the correction through time has done very little damage to the price of the Dollar while at the same time trimming the Dealers’ net short position by 80%. If this correction has indeed been a “continuation pattern”, the Dollar advance that began in 2014 may be gearing up for another leg higher. And it would be occurring with Commercial Hedgers having reloaded, so to speak, on their position. Needless to say, this would have ramifications for most, or all, asset classes and sectors.

We’re not saying the Dollar is set for another leg up. However, Dollar bears might be a little nervous that very little damage has been done to the currency while its excessive status of 12 months ago has largely been worked off.

________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.