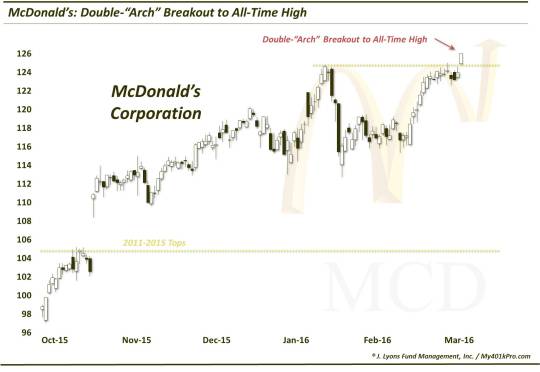

McDonald’s. You Deserve A Breakout Today.

The stock of McDonald’s continued its strong 6-month run today, breaking out to another all-time high.

For the most part, stocks continued their strong push that began yesterday following Fed Chair Janet Yellen’s dovish comments (don’t overlook the fact that these are the last few days of the quarter also). This latest advance comes as many indices are testing – or in some cases, breaking – key resistance levels on their charts. This makes the current move especially important to monitor, despite its arguably dubious timing. The reaction at present levels could lead to the next substantial move in stocks, up or down. One stock that has required little monitoring of late, however, is McDonald’s (MCD) which broke out to another all-time high today.

Back in 2009, after successfully testing its 1999 highs, MCD proceeded to double in price over the next 2 years from roughly $50 to $100. It would spend almost 4 years digesting that run in a sideways trading range. Finally, this past October, the stock exploded to new all-time highs and hasn’t looked back. In early February and again a week ago, the stock reached the $124 level, forming what some surmised may be a potential budding double-top (or “double-arch”?). That fear, however, was seemingly dismissed by today’s trading which took the stock to a new all-time high close near $126.

Besides highlighting what has been a terrific stock over the past 6 months, in particular, it is also a reminder of why we espouse the concept of relative strength. There are countless ways to apply the concept, but relative strength simply refers to the idea of concentrating one’s investments in those areas of the market that are demonstrating strong performance versus the rest of the market.

We aren’t referring to the trendy, flash-in-the-pan type stocks that may deliver a giant move to the upside out of nowhere. The type of relative strength that we are looking for is in longer-term steady performers whose strength is likely to persist over the foreseeable future. While we don’t invest in individual stocks for our clients, McDonald’s would be an example of persistent relative strength that we desire.

It may not be as exciting as trying to catch that mean-reversion “falling knife” trade that seems to entice so many traders. However, a relative strength strategy can be a lot more consistent in delivering positive returns as it allows for a considerably greater margin of error.

So perhaps the next time you have the urge to attempt that “trendy fusion cuisine”-type of mean-reversion trade, you might just stick with some good ol’ “burger and fries”-relative strength instead.

__________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.