Can Germany Prop Up The Rest Of The European Market?

The German DAX stock index re-captured a key technical level on its chart – will the rest of Europe follow suit?

From the early returns, it’s beginning to look like international week here on the blog. While domestic issues are not without their share of interesting developments, we are seeing many noteworthy events among international equity markets. Yesterday, it was Indian stocks. Today, we hop over a continent to talk about Germany as its main stock index – the DAX – hurdled a significant level of resistance.

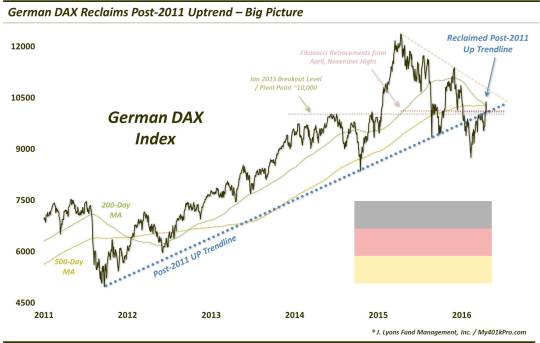

Since 2011, the DAX has been on the rise, with a well-defined Up trendline supporting its ascent. The trendline begins in the fall of 2011 and connects the lows in 2012, 2014 and 2015. At the beginning of this year, the DAX broke down below the trendline for the first time, leading to an immediate 10% drop into its lows of February.

From there, it bounced along with most global equity markets. Its pace of advance, however, has been slowed along the way, apparently, by the broken post-2011 uptrend line. From early March into mid-April the DAX hit the underside of the trendline on at least a dozen occasions. Yet, it failed to reclaim the top side of the trendline every time. In the process, the DAX, along with most every other European index and market, gave the appearance of rolling over once again. In fact, just 2 weeks ago, we were on a major business news network touting the fact that European equities were hitting all-time lows on a relative basis versus the U.S.

What a difference a week makes. As we’ve touched on in several posts, last week may have been a game-changer, at least temporarily, for many of the previously lagging markets, including Germany. A week ago, the DAX began a furious rally that saw the index jump some 7% through today’s close. Furthermore, the index was finally able to close decisively above the broken post-2011 trendline, as shown here…

…and zoomed in.

As the charts show, the DAX was also able to vault above the following other levels of resistance:

- The January 2015 breakout level around 10,000, which has served as a pivot point for the past 2 years.

- The 38.2% Fibonacci Retracement of the April-February decline

- The 50% Retracement of the November-February decline

- The 200-day simple moving average

- The 500-day simple moving average

Now, there certainly remains plenty of overhead resistance facing the DAX, all the way up to the high of one year ago. However, in our view, the reclamation of the post-2011 uptrend line is the key. This line served as solid support for 4 years, then reliable resistance for the past 4 months. It marks as good of a “line in the sand” as any, offering a point of reference from which to trade. If the index can remain above the trendline, it has a chance to mount a much more substantial rally than what looked possible just 10 days ago.

Furthermore, if the DAX is successful at holding the trendline, it would keep the index above the January 2015 breakout level. The longer it holds that, the more conceivable the action becomes as a successful test, or hold, of the breakout level. The early 2016 drop could then arguably be considered a false breakdown of the breakout level. A “successful” hold of the breakout level would imply an eventual extension of the January-April 2015 rally, meaning a new up-leg into all-time high ground, at some point.

That is getting way ahead of ourselves, however. Let’s just take things 1 step at a time. As long as the post-2011 trendline holds, the bulls have the ball, in our opinion. We would caution against getting too complacent, however. That is because, If you look around the rest of the continent, this positive development surely is not unanimous among all the markets. In fact, most of the broad European averages, along with many major country markets like France and the U.K. have failed to reclaim their corresponding broken post-2011 or post-2012 uptrend lines.

While we preach the importance of judging each market on its own merits, that situation does raise questions about the likelihood of the DAX maintaining its position above the trendline. On the other hand, is it possible that Germany could be paving the way for other markets to follow suit in surmounting similar resistance of their own? Is that too much to ask of Germany? We’ll see how it turns out, but it certainly wouldn’t be the first time the country has shouldered the financial load for the continent.

_________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.