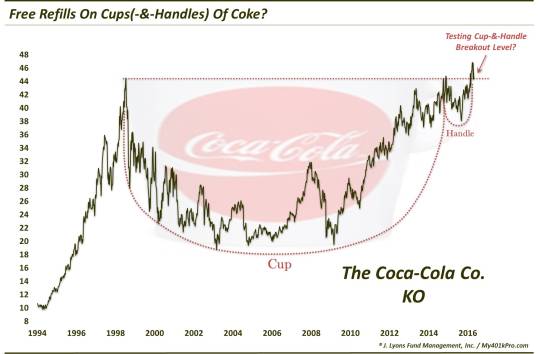

Free Refills On Cups(-&-Handles) Of Coke?

The stock of Coca-Cola is testing the area of its 18-year cup-&-handle breakout from last month.

On March 11, the subject of our Chart Of The Day was the stock of Coca-Cola, symbol KO. The prior day had seen KO break out above its all-time high level that had held the stock in check for 18 years. During that 18 years, KO had arguably carved out a formation on its chart known as a “cup-&-handle”. To repeat our brief discussion on this formation from that March post:

A “cup-&-handle” is historically a pattern with very bullish implications. It involves 2 parts, generally showing the following characteristics:

The Cup: This phase includes an initial high on the left side of a chart (e.g., the 1998 high in Coke around $45), followed by a relatively long, often-rounded retrenchment before a return (e.g., late-2014) to the initial high.

The Handle: This phase involves a shorter, shallower dip in the stock and subsequent recovery to the prior highs (e.g., the 2014-2016 period in Coke).

The bullish theory is predicated on the idea that after taking a long time for a stock to return to its initial high during the “cup” phase, the “handle” phase is much briefer and shallower. This theoretically indicates an increased eagerness on the part of investors to buy the stock since they did not allow it to pull back nearly as long or as deep as occurred in the cup phase. Regardless of the theory, the chart pattern has often been effective in forecasting an eventual breakout and advance above the former highs.

Indeed, following the March breakout in KO, the stock proceeded to tack on another 5% or so over the next month. Today brought a swift halt to that rally, however. Following an apparent earnings shortfall, the stock of Coca-Cola dropped back down nearly 5% today alone. Now, even if you’re not a mathematics major, you could probably calculate that subtracting 5% from 5% means the stock is right back near the initial breakout point of a month ago.

In charting or technical parlance, we call this action a “test”. That is, price is “testing” a previously important juncture or technical indicator. In this case, KO stock is testing the breakout level of its former highs, which marked the top parameters of the 18-year cup-&-handle.

For Coke investors, obviously today was a tough and perhaps discouraging day. However, there may be a bright side – and potentially a significant one. This is especially true if the cup-&-handle interpretation is an accurate one. And even if it is not, an 18-year series of peaks may be just as significant anyway.

Either way, if the breakout is indeed to be successful, meaning a launching of Coke’s stock on to a new substantial leg of advance, today’s test of the breakout level provides traders and investors with a major opportunity. Allowing for some short-term back and forth, if the breakout is to be successful, this test should indeed hold, particularly being the first test.

What does that mean for traders and investors? It means that those who missed the initial breakout are getting another chance to pick up the stock at the same price. And for investors who already owned the stock, or traders who bought the breakout, this gives them an opportunity to pick up more at the breakout level.

You might consider it a “free refill” on Coke stock.

_____________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.