Is Chile’s Stock Market About To Get Hot?

The setup is in place for a breakout of long-term significance in the Chilean market.

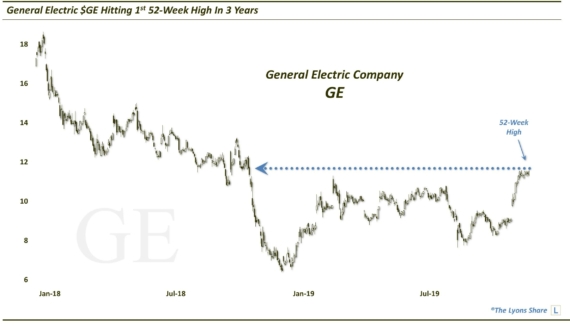

We continue this week’s trot around the globe by heading to South America to spotlight one country’s stock market that been on our radar for some time: Chile. When we look for breakouts, there are a few things that we like to see. The obvious one is the actual point at which price breaks above the significant resistance, be it a prior top, a trendline, a moving average, etc. The less obvious and underrated factor is the initial setup leading up to the breakout. Take a look at Chile’s IPSA Stock Index, for example.

Currently, we see the IPSA arguably moving above the Down trendline that has been in place since 2011, as well as the 1000-day (200-week) moving average. If successful, this could mark a breakout of significant proportions for the Chilean stock market. The kicker, however, comes in the setup.

When we say “setup”, we mean the circumstances surrounding and preceding the breakout. What makes a setup a “good” one? In our view, there are several factors. We will deal with two here, as demonstrated by the Chile IPSA Index. First off, the level from which the breakout move is launched is important. And the more significant the level, the better the odds of a successful and substantial breakout.

For example, witness the level from which the IPSA bounced in January prior to its current “breakout”. This level – around 3400 – was meaningful for a variety of reasons, including:

- It marked the former all-time highs in 2007 and briefly in 2009.

- It marked, at the time, the position of the Up trendline connecting the 2002 and 2008 lows.

- It marked the 38.2% Fibonacci Retracement of the rally from the major low in 2002 to the high in 2011.

- It marked the 61.8% Fibonacci Retracement of the rally from the major low in 2009 to the high in 2011.

As you can see, that was some seriously heady stuff at the level of the previous low. Why is it important that price bounced from a consequential spot like that?

Major chart levels – like magnets – tend to attract prices, eventually. Thus, if an important level has not yet been tested, that possibility will continue to hang in one’s consciousness until it occurs. Therefore, if the odds are that prices will test a certain level, it is best to “get the test over with” and out of the way so that prices can commence their next journey. And given the major importance of the particular level, the odds of it “holding” are very good – meaning that that next journey should be higher.

(One example of an index that has recently bounced without yet testing a key level below is the Indian Nifty, which we highlighted on Monday).

So we know that the level from which a breakout move is launched is key. Secondly, the manner in which the level is tested can also be of importance. Ideally, we like to see a level tested – and re-tested – in order to support the view that prices are ready to reverse – in this case, move higher.

If a level has seen multiple tests, that suggests a better base or more complete bottom process is in place. In the case of the IPSA, prices tested the key 3400 level on 2 occasions, January 2014 and January 2016. Thus, it has potentially put in a solid base, or complete bottom process (or double-bottom).

Therefore, we have 2 key ingredients in place for a potentially more successful and robust breakout: 1) a major level off of which the breakout move was launched, and 2) a comprehensive test of that key level prior to liftoff. All that is left now is for the IPSA to convincingly break its 5-year downtrend.

And just to get ahead of ourselves a little bit here, the potential upside for the index could be massive. In our view, the IPSA likely launched a secular bull market in 2002, with 2 up waves complete (2002-2007 and 2008-2011). If the 2011-2016 formation in the IPSA is merely a consolidation pattern to digest the 2008-2011 gains, the next (and final?) up wave should send the market to new highs – and perhaps considerable new highs at that.

But first things first. The setup is in place. Now we wait for price to break out, which may now be underway. If it is successful, Chile may become one hot market indeed.

_________

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.