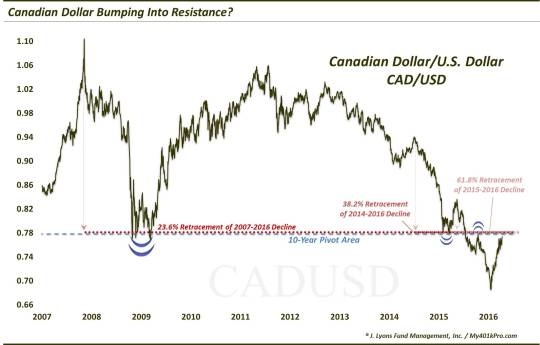

Loonie Rally About To Hit The Brakes?

The brisk 3-month rally in the Canadian Dollar has brought the currency back to the 2015 breakdown level of decade-long support.

We don’t typically cover currencies too closely; however, given the U.S. Dollar’s year-long consolidation, there has been no shortage of interesting developments in the FX market recently. This includes, presently, the action in the Canadian Dollar, a.k.a., the “Loonie”, which has suffered extensive damage over the past few years in conjunction with the deflationary spiral in commodities.

The Loonie’s decline accelerated last July when it broke down below the 0.78 level versus the U.S. Dollar (CAD/USD) which had served as support for the prior decade. Following a swift drop down near 0.68, the currency bounced in January and has now found its way all the way back to near the 0.78 level again.

You’ll note on the chart that the approximate 0.78 level held as support at the major 2008-2009 lows in the CAD/USD and again in early 2015. Following the July breakdown below the 0.78 level, the CAD/USD tested the level in October. The former decade-long support indeed proved to now be resistance as the CAD/USD failed precisely at the breakdown level. As mentioned, the currency proceeded to drop a further 12% drop into January. 3 months later, it has now rallied back to the 0.78 breakdown area again. Will this level serve as resistance once more?

While the fact that the 0.78 level has served as a 10-year pivot point is certainly the best reason to expect the level to act as resistance, it isn’t the only reason. There is also a convergence of 3 key Fibonacci Retracement lines right at 0.78 that may reinforce the area as resistance. These lines include:

- 23.6% Fibonacci Retracement of 2007-2016 decline

- 38.2% Fibonacci Retracement of 2014-2016 decline

- 61.8% Fibonacci Retracement of May-January decline

We would expect this area to provide, at least initial, staunch resistance for the Canadian Dollar. If so, it may be indicative of a broader barrier in the global “reflation” trade that remains in effect currently. If the Canadian Dollar fails decisively at this 0.78 level, and other related assets follow suit, it may clinch the post-January rebound in commodities and commodity currencies as simply a mean-reversion, “dead cat” bounce.

However, if the CADUSD can convincingly break out above the 0.78 level, it may instead suggest that the move of the past 9 months was a massive false breakdown. This would be further evidence that the reflation trade is for real and more durable than merely a dead cat – or dead loonie – bounce.

_____________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.