Investors (Over?-)Prepared For Brexit Volatility

Short-term volatility expectations have eclipsed those of the longer-term, a nearly unprecedented situation given the recent tame market action.

Recent days and weeks have seen a veritable stampede into volatility-based investment products. The concomitant jump in the S&P 500 Volatility Index (VIX) has been unprecedented given the relatively tame action in the stock market. Why all the consternation on the part of investors? No doubt some of it has to do with the referendum in the U.K. on whether to stay in or leave the European Union. And while we hate to mention terms like “Brexit”, it is having an impact on the financial markets. Therefore, we have no choice but to address it, if indirectly. The good news is that, as investors, we can choose to ignore all of the headline “news” on the matter. Instead, it is more helpful to focus on – and possibly take advantage of – the markets’ movements as a result of the issue.

One potential opportunity to exploit comes as a result of this frenzied push into volatility vehicles. While we have no idea what the outcome of the U.K. vote will be, we do know that investors have prepared for potential volatility as a result of it…in a big way. One way of measuring the extent of investor expectations for impending volatility is by comparing near-term expectations versus those farther out.

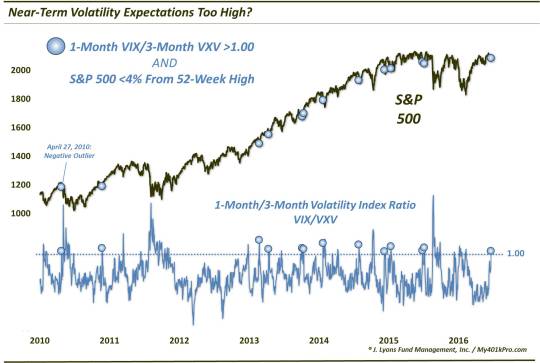

For example, let’s compare the 1-month volatility index, VIX, versus the 3-month volatility index, VXV. Typically, the VIX will be lower than the VXV as there is less time in the near-term for volatility rises to occur. However, when investors get especially nervous, the near-term VIX can at times temporarily rise above the VXV. This generally happens after a severe bout of weakness in the stock market.

As of yesterday, the VIX did indeed climb above the VXV, indicating a heightened degree of nervousness on the part of investors. The odd thing about this reading is that there has been very little damage done to stocks, relatively speaking. In fact, since 2007 (the inception of the VXV), there have been 289 days that saw the VIX close above the VXV. At just 2.01% away, the S&P 500 is closer to its 52-week high than all but one of those days (10/15/2013).

Furthermore, this is just the 13th time since 2007 that the S&P 500 was within 4% of its 52-week high on a day that the VIX closed above the VXV. This chart shows those 13 occurrences (there were none before 2010).

Here are the dates of those 13 events (not including consecutive dates):

4/27/2010

11/26/2010

2/25/2013

4/15/2013

10/7/2013

10/15/2013

1/24/2014

7/31/2014

12/12/2014

1/14/2015

6/29/2015

7/8/2015

6/22/2016

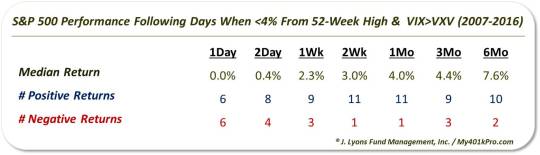

So is there a common thread among these occurrences? Well, we will first note that the stock market environment since 2010 has generally been a bullish one. That said, the performance of the S&P 500 following these events has been significantly and consistently positive over the short to intermediate-term. Take a look.

Why the overwhelmingly positive results? Presumably the conditions indicate a situation whereby investors are hedged, or prepared, for potential stock market adversity, or headline risk. Thus, in the event that such potential adverse conditions arise, the widespread hedged condition cushions any negative market reaction. And conversely, if the adverse potential does not arise, these elevated hedges can necessitate a short-covering rally in stocks, and “long-covering” in the volatility market. This can be particularly so as markets push back near their highs.

Interestingly enough, we saw an example of this “over-preparedness” on the part of investors in a post exactly 1 year ago. It discussed the record jumps in European-based volatility indexes relative to the U.S. in the lead up to, wait for it – the referendum on “Grexit”. In that instance, like those in the table above, the massive volatility hedging proved to be unwarranted as European stock markets were some 6%-8% higher a month later and volatility indexes 30%-40% lower.

Will the recent rush into volatility hedges prove unwarranted again? We’ve no idea. Perhaps investors, collectively, have the correct bead on the Brexit risk. However, based on their track record of over-preparedness, we would not count on these hedges paying off. More likely, investors will be caught holding their umbrellas on a sunny day in London. We’ll see.

________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.