Will Epic Line Of Resistance Turn Support For Japanese Stocks?

The Japanese Nikkei Index is testing the top of its broken decades-long trendline; will it be as reliable as support as it was as resistance?

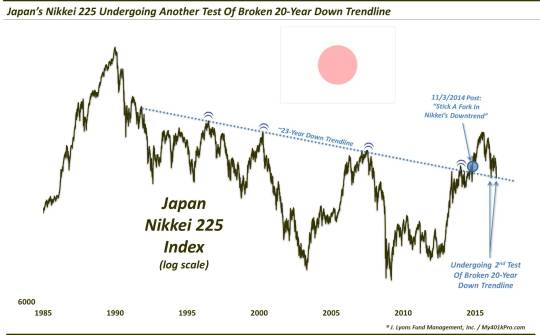

It’s quickly shaping up as Trendline Week in the markets. And while that may not sound as cool as Shark Week, it can be pretty exciting for those of us who dwell in the charts. We say this on account of the myriad of significant trendlines that are being tested or breached this week across global markets (by the way, expect a special edition of Trendline Wednesday on Twitter tomorrow; follow us @JLyonsFundMgmt). Today’s version features one of the most prolific trendlines in the modern era, although it has certainly flown under the radar this past week given the tremors elsewhere in the world. We are talking about the decades-long Down trendline that held Japan’s Nikkei 225 in check following its blowoff top in 1990.

The trendline extended from the mid-1990′s until it was finally broken in October 2014, as we noted in a post back then. After popping higher by another 30% following its breakout, the Nikkei has settled back down since peaking last summer. In the equity selloff that gripped the globe early in the year, the Nikkei fell all the way down to test the top-side of the broken 20-year trendline. It successfully held back then, bouncing some 20% into April. Presently, the index finds itself again testing the top of the broken trendline.

So will the trendline hold again? We shall find out. On the one hand, it is a bit discouraging to see the trendline already being tested again given the considerable rally throughout much of the global equity world since February (minus the past few days, of course). If the recent Brexit-induced selling is the start of something more ominous and durable, the fact that the Nikkei is already testing this key potential support is not an positive development.

On the other hand, the trendline was the dominant force upon Japanese equities for over 2 decades, so its potential role in supporting the index now should not dismissed. We know many market observers will question whether Japan’s stock market can mount a longer-term rally in the face of potential headwinds elsewhere in the world. Specifically, should the secular bear markets re-engage in Europe and the U.S., would it still be possible for Japan’s market to rally?

The answer is, yes, anything is possible in markets, particularly when there is so much skepticism towards the possibility of a particular event. So it appears to be with respect to Japanese equities. Whether due to the county’s demographics, economic state or whatever, there seems to be no shortage of rationales for why it will be impossible for the Nikkei to rally. Don’t get us wrong, we are not making that prediction. We are simply saying it is possible.

Recall that the market languished badly during the 1990′s, even as most global equity markets were soaring. Furthermore, the Nikkei continued to make new lows into the 2008-2009 financial crisis, making it roughly 2 full decades of lower highs and lows. That is a brutal secular bear market that accomplished what secular bears are supposed to, i.e., remove the excessive conditions that existed at the end of the preceding secular bull market (e.g., P/E ratios dropped from around 90 in 1990 to the low teens).

Thus, Japan’s equity market is arguably in a position to support a durable, or secular, bull market. Whether it transpires or not we don’t know. What we do know is that investors – bulls and bears – presently have a line in the sand, in the former trendline, that they can use to direct their investment posture. Should the Nikkei hold the top of the broken trendline, it could well serve as a springboard to a substantial rally. Should it break back below the line, the Nikkei could find itself back in the subterranean doldrums where it spent the better part of the past 2 decades.

We should get resolution on that shortly.

________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.