An Imminent Stock Market Top Would Be Unprecedented

The month of July has never played host to a major stock market top.

With the major stock averages breaking out into all-time high ground, investors (especially the bears) are pondering what could possibly derail the market now. One factor that has been the topic of some discussion recently is seasonality. Specifically, we have seen numerous forecasts calling for an impending stock market top, or at least a summer swoon. But while anything is possible in this market, a major market top right now would actually be unprecedented.

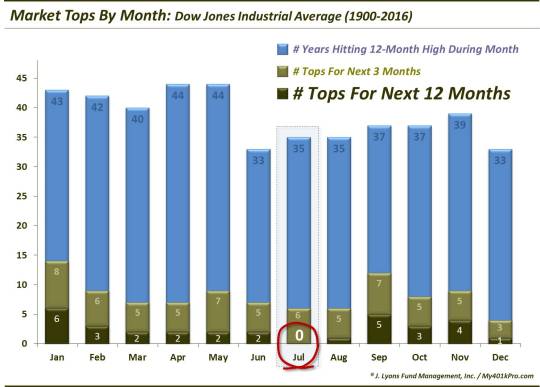

Why is that? Well, since 1900, using the Dow Jones Industrial Average (DJIA) as a gauge, the stock market has never put in so much as a 12-month top in the month of July.

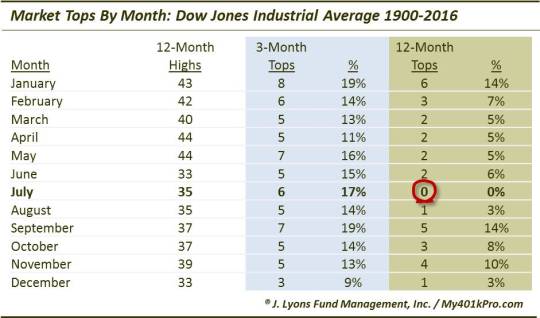

Here is the same data in Table form.

Now, again, anything is possible in this market. There is certainly a first time for everything. Furthermore, seasonality is typically but a minor influence on stock prices. However, considering that in the past 116 years, the stock market has not once formed a 1-year top during the month of July, it at least causes us to wonder if there isn’t something structural to the phenomenon.

Just consider the fact that the DJIA has scored a 52-week high during 35 July’s since 1900 and not a single one of them held as the high for the next 12 months. Contrast that with January or September, for example, that have each seen the DJIA form a 1-year top during 14% of the years in which the index hit a 52-week high during the month.

That’s not to say that the market cannot put in a top of some significance here in July, even if following the historical script. That’s because the DJIA has put in at least a 3-month top on 6 occasions in July. They include fairly recent examples in 1998 and 1990, which may be coloring the perception of those issuing the July alarm bells.

There have also been some near-misses for the month of July in terms of putting in a 12-month top. 2007 saw just a slight, temporary higher high in October which prevented a July 12-month top. And even last year saw some indices (e.g., the Nasdaq) put in a top in July that has, thus far, held as the index’s top since.

Therefore, a shorter-term top of some significance, in the DJIA or other indices, cannot be ruled out. However, those folks calling for an imminent, long-term market top here in the month of July should understand that such a development would be unprecedented in the past 116 years.

________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.