Dow Industrial-Utility Divergence A Warning — For Bears?

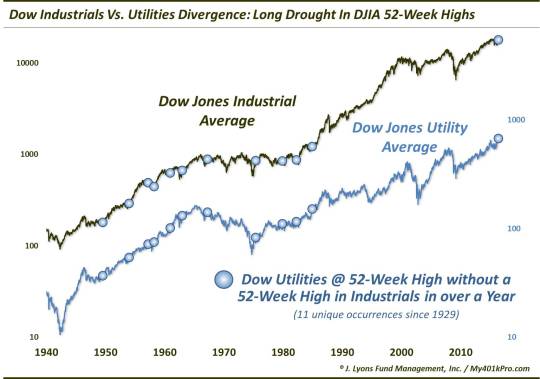

While the Dow Utilities continue to make 52-week highs, it’s been over a year since the Dow Industrials did the same; historically, that has not been a problem for stocks.

2015 was the Year of the Divergence in the stock market. Not since 1999-2000, and perhaps never before that, had we seen so many situations whereby one index was hitting new highs while another index, or perhaps indicator, was not. And while it may be difficult to time the ramifications of such divergences, they often do result in negative consequences for stocks – eventually.

We were very vocal in sounding the alarm bells last year based on some of the divergences: specifically, those that we had tested and which showed a historical basis for providing such alarms. Most of the divergences that concerned us pertained to the deterioration in the market’s internals, even as the major averages were hitting new highs. Stocks eventually did pay the price for this internal weakness in sharp selloffs last summer and early 2016 (though, they have come back with a vengeance).

2016 has been a different story. I’m not sure if we’ve posted a single piece focused on a market divergence. Why is that? Simple: there have been precious few 52-week highs in the market indices to produce any divergences. Sure there have been various sectors and industries to go to new highs, but nothing that would traditionally sound the alarm bells. That said, one of those sectors that is hitting new highs this year – utilities – was actually the subject of a divergence post we wrote last year…only in an opposite fashion.

Specifically, we looked at instances when the Dow Jones Industrial Average (DJIA) was hitting 52-week highs while the Dow Jones Utility Average (DJU) was well below its own 52-week high. Interestingly enough, not only did we find evidence that his was a legitimate longer-term concern, it turned out to be a much bigger concern than the more ballyhooed divergence between the Industrials and the Transports, i.e., the “Dow Theory”.

Given our existing research into the topic, we thought we would revisit the matter due to an emerging situation between the two Dow Indices. The difference is that the roles are reversed this year, with the DJU hitting all-time highs while the DJIA has failed to join it for some time. In fact it has been more than a year since the last DJIA 52-week high. And that spurred our fresh look into the topic.

Specifically, we looked at instances going back to 1929 when the DJU was at a 52-week high while the DJIA had failed to do likewise in more than a year. We were curious about whether this reverse divergence merited similar warnings as the one last year. As it turns out, we found 11 prior unique instances meeting this criteria.

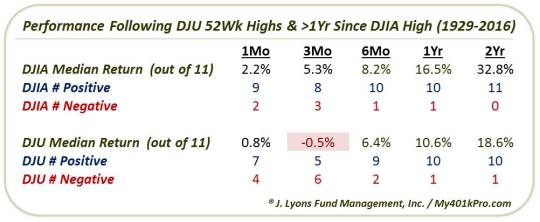

So, does the price action following these historical signals suggest we start ringing the alarm bells again? In a word, no. Returns, especially for the DJIA, were very good, in particular in the long-term.

As you can see, the DJIA has turned in terrific performance following these signals. Not only were the median returns quite strong across the board, but both indices turned in near-unanimous gains in the longer-term. And incidentally, the DJIA went on to score a new 52-week high within months following all but one of the incidents (in 1957).

One interesting thing about the location of these signals (besides the recent 34-year span without one) is that they took place evenly within both secular bull and bear markets. Thus, we cannot place blame or credit on the prevailing market environment.

Will our present circumstances result in similarly strong performance? It remains to be seen. We certainly have our share of longer-term concerns that would seem to fly in the face of these results. Likewise, our suggestion for bears looking for a reason or catalyst for lower stocks prices would be to look elsewhere other than this divergence.

__________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.