Is Resource Reflation For Real?

A number of key charts pertaining to the basic resources sector have scored important breakouts in recent days.

As large-cap averages break into all-time high ground, a key question on many investors’ minds is does this move have legs – or will it prove to be a bull trap? One factor that would certainly help give the move “legs” would be the continuation of the bounce in commodity and resource based equities. After getting absolutely pummeled in the deflationary spiral over the past few years, resource stocks have enjoyed a resurgence since the January-February lows. Then again, so has the entire equity market. So, is this rally in basic resource stocks merely a mean-reversion bounce, in line with overall market beta? Or is it something more substantial – a legitimate reflationary move. While we still can’t say with certainty either way, evidence continues to pile up that we are witnessing more than simply a dead cat bounce.

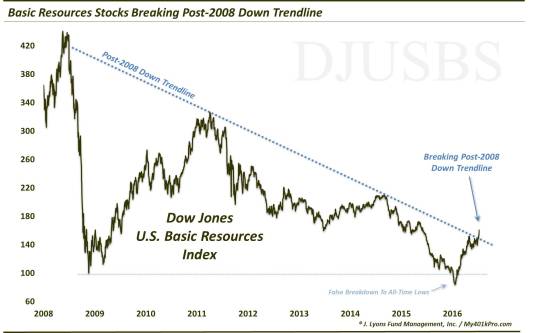

Why do we say that? Well, as you may know, as active risk managers, we don’t spend any time opining about why the market is doing what it is. All we are concerned about is what IS happening in the market. And in the resource sector, a number of positive developments are taking place. For one, one of the key and most comprehensive indices in the area, the Dow Jones U.S. Basic Resources Index, has just scored an important technical breakout.

Specifically, the index has just overtaken its Down trendline extending from the sector’s peak in 2008 and connecting the peaks in 2011, 2014 and several touches from April to June of this year.

One other interesting facet of the chart of the Dow Jones U.S. Basic Resources Index catches our eye. During the January selloff, the index broke below its low from 2008. However, it was able to recover that level in short order and continue to move higher. This type of “false breakdown” can be as powerful in jump-starting a move to the upside as a breakdown can be to the downside.

We pointed out a similar false breakdown in the gold miner stocks back in January that served as a springboard to an epic rally since. It should thus be no surprise that the

Dow Jones U.S. Basic Resources Index

has a large number of mining stocks, and specifically, gold mining stocks, in it. And if the index is to follow the lead of the gold miner indices, there could be plenty more upside to go.

Since the

Dow Jones U.S. Basic Resources Index is perhaps off the radar for most, we will show one more chart that may be more familiar and at least more accessible for investors. The SPDR S&P Metals & Mining ETF (ticker, XME), is one of the most popular mining/resource funds in the market. Its chart is also showing similar characteristics as the Dow Jones U.S. Basic Resources Index.

Note how XME has recently broken above its post-2011 Down trendline. This is an important development regarding the prospects for more upside in the ETF. Additionally, note also how XME suffered a similar false breakdown early this year. The bounce off the low has already seen the ETF more than double in price. Given the damage seen in the fund over the past 8 years, this bounce could just be the beginning of a larger bull market.

The same goes for the Dow Jones U.S. Basic Resources Index and the entire sector. After the deflationary spiral since 2008, this year’s rally could be nothing more than a mere mean reversion bounce. The potential upside to a legitimate, cyclical bull market would be many multiples of the bounce we’ve seen. Whether that type of a move is in the works or not, we cannot know for sure. We just need to gauge it one step at a time.

But the steps made by the sector this week have been important ones in broadening the possibility of such a cyclical bull market.

_____________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.