A Potential Green Shoot In Wheat Prices?

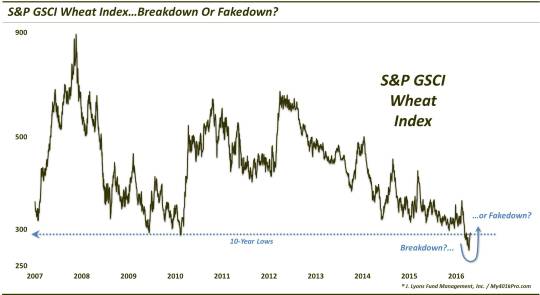

Wheat prices recently dropped to 10-year lows – but are threatening to pull off a potentially major false breakdown.

Just 12 days ago, our Chart Of The Day looked at an index of grain prices – the S&P GSCI Grains Index – noting that it had dropped to its lowest level since its 2007 inception. For a complex that had been badly beaten up for 8 years running, this was a new low in futility. Then again, as we mentioned in the post, it also provided an opportunity for grain bulls. If the index could only recover the breakdown level, it could set up a major false breakdown and spur a significant reversion bounce. And as the new lows in the Grain Index were marginal at best, it was able to reclaim the breakdown level in short order, producing a solid 6% bounce over the past 7 days.

Today, we look at one of the contracts within the Grain Index that is attempting to follow the same template as the broader category. Wheat has served almost a caricature of the Grain Index with exaggerated moves over the past decade. As the Grain Index was rallying just over 100% from 2007-2008, the GSCI Wheat Index was jumping 180%. And when the Grains Index dipped just about a percent below its 2008-2010 lows a few weeks ago, the Wheat Index undershot its lows by 8%. However, as Wheat prices have demonstrated, the more stretched commodity prices get in one direction, the more powerful the reversion move can be in the other. And presently, Wheat is trying to recover its breakdown level and potentially put in its own false breakdown.

As the chart shows, the Wheat Index has now rallied ever so slightly above the breakdown level represented by the 2009-2010 lows. If it can recover that level handily, we may very well be looking at another long-term false breakdown. Such a scenario could potentially produce a substantial rally, and a potential long-term bottom.

That said, a recovery of the breakdown level does not guarantee a false breakdown or any substantial price increases. Wheat prices would still be in a longer-term downtrend with significant layers of resistance above. However, as with the Grain Index, the breakdown level would likely be the key level to focus on, long or short. Above the level and a bounce of some magnitude is likely for the bulls (and the opposite is true for bears below the breakdown level).

We also mentioned in the Grain post that while, generally speaking, futures positioning (via the Commitment of Traders [COT] report) was somewhat favorable for the complex, it was not as extreme as it had been earlier in the year. Thus, we surmised that should grains attempt a false breakdown and rally, they may not have as favorable a tailwind as they were working with several months ago. If there was one exception, though, it might be Wheat. There, we see the “smart money” commercial dealers holding a sizable net long position, only surpassed by a couple weeks earlier this year. So, if prices do indeed attempt a rebound, this dynamic may provide some added fuel.

Ultimately, again, we would recommend keeping it simple. If Wheat prices can reclaim

– and remain above –

the breakdown level, we could see this “green shoot” lead to prices shooting higher. Then again, if prices are unable to recover their all-time lows, the green shoot may be more weed than wheat.

_____________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.