Is Smart Money Holding A Record Bet On Volatility Rise?

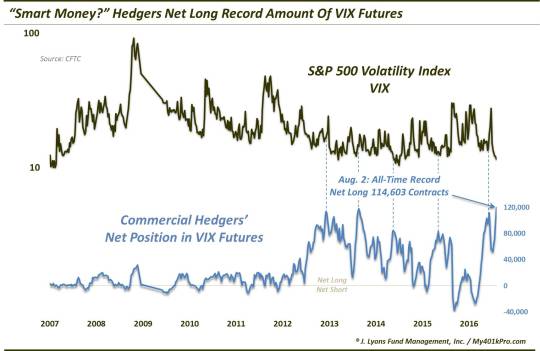

Commercial hedgers – who are most often correctly positioned at market turns – are currently holding their largest ever net long position in VIX futures.

August has

typically

been a slow month in the financial markets as many participants take time off from work. This month is no different with trading volume anemic, price movement lethargic and volatility expectations at rock bottom. At least for the majority of investors, volatility expectations are extremely depressed as evidenced by the S&P 500 Volatility Index (VIX) currently threatening sub-11 levels for just the 4th time in 10 years. Furthermore, speculators in VIX futures are currently holding a near record net short position, according to the CFTC.

Taking the other side of that futures position, of course, are the commercial dealers, or hedgers. As we have discussed on many occasion, these hedgers are often considered “smart money”. This is a bit of a misnomer which causes some confusion every time we use the term. It is not that these hedgers (e.g., banks and large financial institutions) are always right. In fact, they can be wrong for long stretches at a time in a strong trending market. However, we know what typically occurs when the speculators’ positioning becomes too one-sided or extreme – the market reverses on them. And as they are on the other side of the position, these commercial hedgers are typically correctly positioned at major market turns. Thus, the “smart money” moniker.

This is relevant now due to the aforementioned speculator position. As such, commercial hedgers currently own their largest net long position in the 10-year history of the VIX futures contract.

As always, this post comes with all the usual caveats, including the one about the hedgers not always being right.

Another challenge, particularly with the VIX contract is the explosive rise in open interest in recent years due to the increased popularity of volatility related trading products. Because of this, the current regime in the VIX futures market is quite different than it was prior to 2012 especially. For example, what formerly used to constitute an extreme in speculator and hedger positioning is no longer be the case. And while the current “record” level suggests an extreme as it is unprecedented, given the growth of volatility popularity, we cannot even be confident of that.

Additionally, in hindsight, the peaks that we do find in hedger net longs over the past several years have not necessarily corresponded to major volatility turning points to the upside. For the most part, they have led to short-term lifts at best. Their large early June net long position, for example, led into the post-Brexit spike in volatility. This was, of course, a short-term event, however, like several other examples.

Thus, while we would certainly rather see commercial hedgers holding a net short position if we were stock bulls, in our view, the data series has not been “smart” enough, historically, to warrant an overly cautious stance.

_____________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.