Time To Bank On Financial Stocks Again?

After failing to keep pace with the equity rally over

the past 4 months, financial stocks are finally breaking some

key technical resistance.

Last week, we noted a few data series suggesting that stock

market sentiment may finally be getting a bit too bullish or complacent. With

many late-comers now back in the market, the tailwind that existed from

February to July has largely died down. Indeed, sentiment should now turn into

a headwind for stocks. And while that doesn’t necessarily mean an end to the

rally, it makes the road higher more difficult. One thing that would aid in the continuation of the rally, as we also noted last week, would be the additional participation by lagging segments of the market. We have seen examples of this recently in technology, biotech and elsewhere. And after lagging for many months, it finally appears as if banks and other financial stocks may be attempting to mount a charge higher as well.

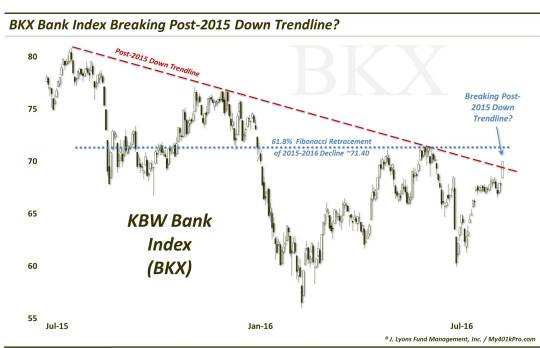

We say this on account of a couple positive developments on the charts of 2 of the most popular financial indices. First, we see the KBW Bank Index (BKX) potentially breaking its Down trendline stemming from its July 2015 highs (on a log scale, this breakout is far less definitive, though, the linear scale has a cleaner trendline).

As the chart shows, the 61.8% Fibonacci Retracement (also corresponding with the April-June highs and the 500-day moving average) looms just 2% above, around 71.40. However, a trendline break may well provide enough momentum to get the index through that level and to the next significant line of resistance (which may be the 78.6% Fibonacci Retracement/late-2015 highs near 75.50, or ~8% away).

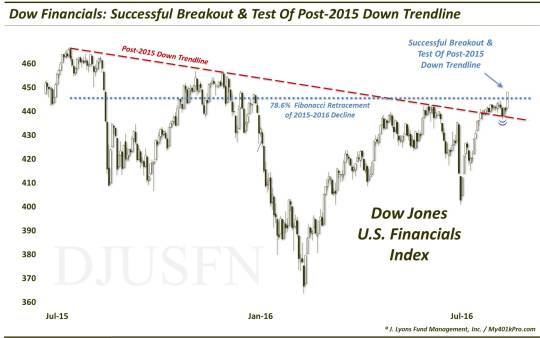

Even more constructive is the Dow Jones Financials Index. This index not only broke above its corresponding post-2015 Down trendline (on both linear and log scales), but it also tested that breakout level last week. It passed that test with flying colors in the wake of the July Non-Farm Payroll numbers, jumping to a new year-to-date high on Friday.

In the process, the DJ Financials also hurdled the 78.6% Fibonacci Retracement of the 2015-2016 decline which lay in the midst of the late-2015 highs. Above here, the 2015 (and 8-year) highs are a mere 4% away.

After breaking the key resistance on Friday, new highs finally seem like a reasonable goal for financials after lagging conspicuously since April. And if they can do so, they very well could help perpetuate the broad equity rally that may soon be in need of new blood.

_____________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.