Are Japanese Equities Ready To Rise Again?

After successful tests of its broken multi-decade downtrend, Japan’s Nikkei 225 has a chance to commence a new upleg.

We’ve been pointing out the thinning nature of the stock market rally of late. In fact, as recently as yesterday we noted that just one of about 150 Dow Jones industries, Toys, was hitting a new high. And while the technology sector continues to make some strides, the stock rally is going to need an infusion of new fuel if the rally is to be perpetuated. One area of potential fuel could be international markets. We have seen a resurgence in various regions around the globe, including Latin America and emerging Asia. One more established market may also have an opportunity to join that mix: Japan.

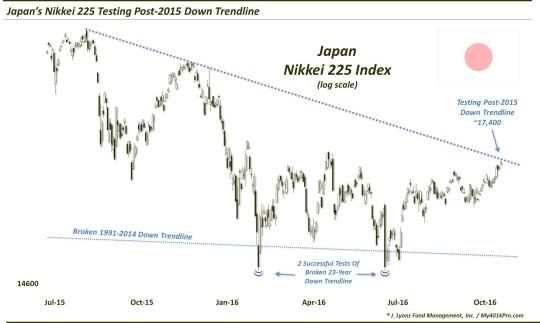

Now we have been tracking the Japanese equity market for decades. Following the bursting of its bubble in 1990, Japan’s stock market went nowhere but down for the next 2 decades. In the process, one of Japan’s main stock indices, the Nikkei 225, formed one of the most epic trendlines of the modern era. This Down trendline stretched from 1991 until late 2014 when the Nikkei finally broke out above the trendline.

That breakout would see the index follow through to the tune of another roughly 25% by the summer of 2015. From there, the Nikkei commenced a pullback that would last for the next 12 months. Along the way, the average would test – on 2 occasions – the top of its broken multi-decade Down trendline. We covered these tests in February and June. Both times, the index would successfully hold above the trendline.

Our contention was that, given the dual successful tests of the epic broken trendline, the Japanese equity market had the potential to re-ignite its post-2012 bull market and begin a new, durable leg of advance. Of course, potential is nothing without action and the bounce in Japan’s stock market has been less than inspiring, so far. That said, the market has hit its stride a little bit just recently. However, this recent bounce has the Nikkei 225 testing its post-2015 Down trendline (on a log scale) at the moment.

This post-2015 Down trendline could pose at least a short-term obstacle for the Nikkei and we’ll assume the line holds until it doesn’t. If the index is able to break out above the line, it would suggest that a more durable intermediate-term rally may be in the works. It could also provide an influx of new fuel to a global equity rally that appears to be running out of gas.

That all remains to be seen. But as we have stated before, given the multi-decade secular bear market in Japan, followed by the break of the bear market downtrend and 2 successful tests of the breakout level, the potential for a longer-term bull market would appear to be in place, from a technical perspective.

First things first for the Nikkei, however, and that’s to rise above its post-2015 downtrend.

_____________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.