Traders Breathe Unprecedented Sigh Of Relief Following Election

Stock market volatility expectations saw the biggest drop on record following the election.

In the buildup to the presidential election, we queried whether “Investors Were Over-Prepared For Election Volatility?”. The reason behind that observation was that near-term (e.g., 9-Day) volatility expectations, via the VXST, had jumped to the 3rd highest level ever relative to the 1-Month VIX. This was despite just moderate stock declines at the time. It was obvious that they were nervous about something, i.e., the election, other than mere price declines. But had they gone overboard with their volatility bets?

We looked back at similar historical extremes and came to a somewhat surprising discovery. As we stated in that November 1 post:

Now, normally our inclination upon seeing a sentiment reading at an extreme would be to fade it. After all, the crowd is notoriously wrong at extremes. However, the funny thing about this VXST/VIX indicator (and much of the volatility trade in general) is that the extremes are often warranted, at least in the short-term.

And:

That is, more often than not, a spike to an extreme in the VXST/VIX ratio initially led to short-term weakness, prior to a rebound.

This short-term weakness played out again as stocks would continue to sell off for another 3 days before bouncing. Furthermore, on election night, some equity futures actually went limit down before recovering prior to Wednesday’s open. Thus, the relative spike in short-term volatility expectations once again led to further selling in the interim prior to the big bounce of the past 2 days.

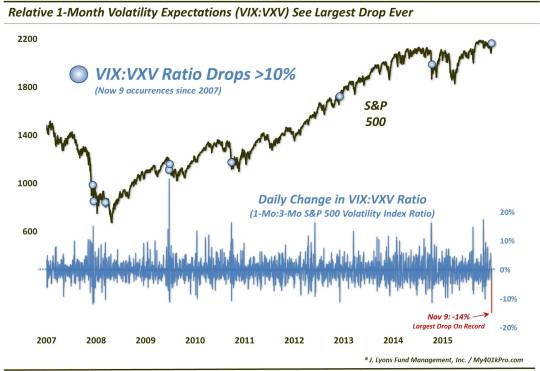

Now, we find the shoe on the other foot (sort of). That’s because, the day after the election, relative shorter-term volatility expectations (this time, the 1-month VIX versus the 3-month VXV) dropped from 1.04 to 0.88, or a decline of 14%. Since the inception of the VXV in 2007, that is the largest single-day drop in the VIX:VXV ratio on record.

Is this action also characteristic of “smart money”, if just temporarily? Or is this a sign of complacency to be faded? We looked at the limited precedents that even approached today’s 14% drop in the VIX:VXV. Specifically, we found 8 instances of 10% daily drops in the ratio. These were the dates:

10/20/2008

10/27/2008

1/21/2009

5/7/2010

5/10/2010

8/9/2011

10/16/2013

8/27/2015

While these episodes were all unique, most of them saw somewhat similar circumstances around the signal, i.e., a drop in the VIX:VXV from elevated levels due to recent stock market weakness.

What did the stock market do following these signals? In the very short-term, there was some evidence that such a drop in volatility expectations was warranted. 1 week after the signals, 5 of the 8 events were higher. And within a week, 6 of the 8 saw the S&P 500 higher by at least 1% at some point. After one week, the volatility selloffs did not look so smart.

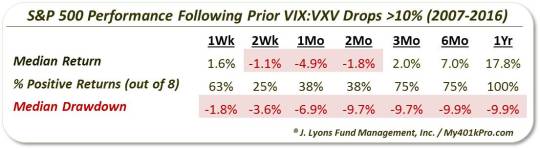

By the 2-week mark, 6 of the 8 had turned negative, all by at least -1%. One month following the signals, 5 of the 8 were negative, with a median return of -4.9%. 5 of 8 were still negative after 2 months. Beyond that, returns normalized. Here are the stats:

One potential bit of good news for bulls is the similarity between the current signal and the 2013 episode. That is because they are the only 2 instances showing a positive 1-week or 1-month return at the time of the signal. And that 2013 signal saw the S&P 500 show positive returns over every subsequent time frame out to a year.

So what’s our take? We would probably designate this data point a “slight negative” for stocks given the precedents’ poor median returns in the weeks and months following the signal. In other words, after becoming overly prepared for post-election volatility, traders may now be just a little too comfortable that the stock market is out of the woods.

_____________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.