Does This Signal Mean Smooth Sailing For Santa Rally?

The VIX just notched a 3-month low; previous early-December occurrences have been generous to stock investors.

With 2017 fast approaching, all matters of year-end and December stats will be flying around. We may well be contributors to that phenomenon, though we will certainly endeavor to share relevant content as opposed to the trivial. Why focus on December-specific stats anyway since it’s just another month? Well, undoubtedly, there are some dynamics pertaining to year-end that make the month unique indeed – so we don’t have a problem with it. In fact, we’ll share a statistic today.

In past years, we’ve written several posts regarding December spikes in the S&P 500 Volatility Index (VIX). Our finding was that stocks had a tendency to do very well into year-end after such spikes in December. In fact, their record was perfect prior to the last few years. But that’s how markets work, i.e., once a phenomenon is identified, it gets exploited until it vanishes.

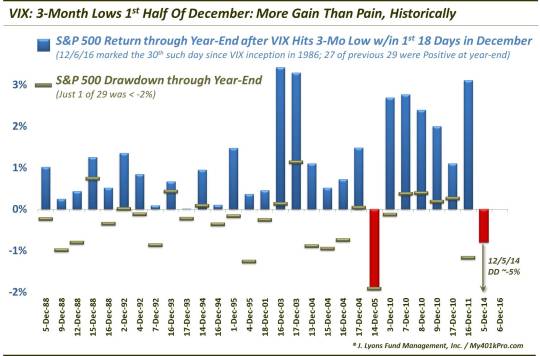

Today’s post looks at the opposite scenario. That is, what do stocks do after very subdued VIX readings in early December? Specifically, we looked at occasions when the VIX made a 3-month low, as it did today, during the first 18 days of December. While December has generally been a strong month, it has also not been immune to some adversity during the middle part of the month. Therefore, our expectation was that stocks had perhaps struggled following historical occurrences – if not through year-end, at least intra-month. That has not been the case.

Since the inception of the VIX in 1986, today marked the 30th time that it hit a 3-month low during the first part of December. Of the prior 29, 27 showed a positive return in the S&P 500 from that date into year-end, with a median return of +0.95%. Even the median drawdown until year-end was very contained, at -0.23%, with just one date seeing a drawdown before year-end of more than -2%.

So, like VIX spikes in December, VIX drops have tended to work out well for investors as well. Maybe we should chalk up much of the success to December’s typical strength overall. Although, as we mentioned earlier, mid-month adversity has often plagued the month of December – but not in this sample.

Again, one thing to keep in mind is that once such overwhelming tendencies are identified, they tend to get exploited away. Therefore, we can’t blindly assume that this track record will keep up. Additionally, if we place more weight on recent events, things become slightly less rosy. That’s because the last occurrence took place on 12/5/2014 and resulted in 1 of the 2 losses for the S&P 500 – and the one drawdown greater than -2% (-4.9% to be exact).

All in all, however, the preponderance of evidence lies with the bulls. Far from leading to a mean-reversion spike in the VIX and drop in stocks, 3-month VIX lows in early December have almost unanimously brought about continued favorable market action through year-end. That would suggest that perhaps the Santa Claus Rally is set for smooth sailing.

_____________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.