Global Stocks Breaking Decade-Long Resistance

The Global Dow Index has broken above its post-2007 downtrend.

One theme we highlighted coming into 2017 was the potential chart resistance facing many global equity markets following the sharp “Trump rally”. This included the Global Dow (GDOW), a broad index of mega-cap global companies, as we mentioned in a late December post. The specific resistance we noted pertaining to the GDOW in particular was a Down trendline stemming from its 2007 all-time high and connecting the tops in summer 2014 and spring 2015.

This trendline held the GDOW back from December into mid-January. However, this week’s global equity rally has seen the GDOW eclipse that post-2007 Down trendline, currently near the 2590 level.

The break of this 10-year trendline removes a major chart impediment and opens up considerable upside for the GDOW. That said, it is not necessarily all free and clear for the index (though, it never is). One immediate obstacle facing the GDOW is the lateral resistance in the 2640′s range, representing the 2014-2015 highs. Yesterday’s high in the index was 2638.54, so we are essentially there now. A pause here and possible test of the trendline breakout level near 2590 would not be a surprise.

As we have mentioned often regarding the Global Dow, one reason we like tracking it is that it adheres very well to various technical charting analyses.

This again may be a surprise for some to learn since there is not much actual money traded based off of it. There is a U.S.-based ETF, however, that tracks the GDOW. It is the SPDR Global Dow ETF, ticker, DGT. And since the Global Dow is priced in U.S. Dollars, the DGT does not have the currency headaches that most internationally-focused equity ETF’s do. For that reason, it tracks the GDOW pretty closely and it too broke above its post-2007 Down trendline this week.

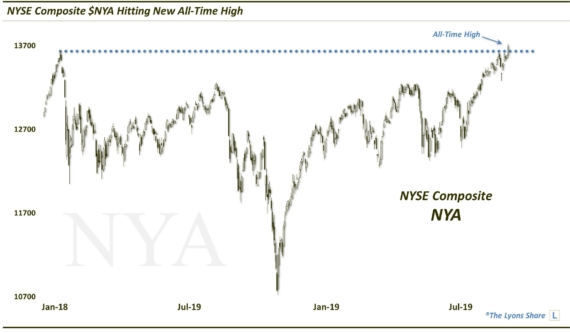

The theme of this week in the equity market has been “breakouts”. And while everyone is well aware of Dow 20,000 by now, and perhaps the more important breakout in the NYSE that we wrote about on Wednesday, it has not just been about domestic stocks. International stocks, which have for the most part lagged their U.S. counterparts for many years, have improved their technical prospects significantly in recent weeks and months. This includes the Global Dow Index, a good sign for the intermediate-term prospects for international equities.

________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.