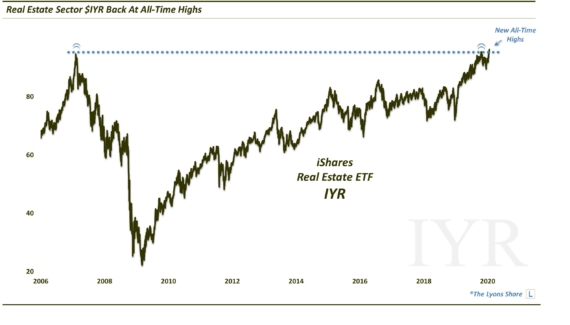

Basic Resource Stocks Clear Another Major Hurdle

Basic resource stocks continue their strong rally, breaking a 9-year downtrend.

We have mentioned on many occasions the recent relative strength shown by stocks having anything to do with commodities, natural resources, basic materials, etc. This impressive strength is especially true of the past 12 months as the resource equity space, badly beaten down for roughly 8 years, has mounted a compelling attempt at a major reversal to the upside. And since the presidential election, in particular, these stocks have overcome some key potential hurdles in furthering their long-term turnaround story. A prime example can be seen with the Dow Jones U.S. Basic Resources Index.

In late November, we posted a chart laying out what we thought might be a formidable confluence of potential resistance for the index, including:

- 23.6% Fibonacci Retracement of 2008-2016 Decline ~168

- 38.2% Fibonacci Retracement of 2011-2016 Decline ~177

- 61.8% Fibonacci Retracement of 2014-2016 Decline ~163

- The Post-2008 Down Trendline (on a log scale), connecting the 2011 High ~178

The DJ Basic Resources Index was trading at around 172 at the time, so right in the thick of the resistance cluster. Over the following week, the index would bounce as high as 179, squarely testing the post-2008 Down trendline. As it turns out, the trendline held and prices commenced a 2-month long consolidation, holding below the post-2008 trendline – until now.

In the past few days, the index has broken out above the well-defined downtrend line, seemingly overcoming another hurdle in its long-term turnaround story.

Obviously, the break above the former resistance line has to be sustained in order for it to be meaningful. Furthermore, while prices have surmounted the down-sloping post-2008 trendline, they have not convincingly surpassed that lateral, early December high. So, as always this developing breakout needs to be monitored.

However, at this point, basic resources stocks appear to have cleared yet another key hurdle as they continue to demonstrate persistent relative strength – and continue to pile up evidence in favor of a major cyclical upturn.

_____________

Like our charts and analysis? Get an all-access pass to our complete macro market assessment at our new site, The Lyons Share.

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.