Global Stocks Score Another Key Breakout?

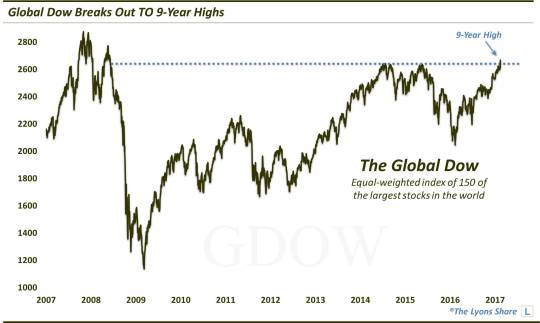

A resurgence among international stocks continues as the Global Dow Index just broke out to a 9-year high.

It is no secret that the U.S. has led the way in the global equity rally over the past 8 years, and continues to do so. Meanwhile, international markets, as a whole, have been subject to fits and starts, at best. Presently, international stocks are experiencing one such start (or is it a fit?). The point is that these foreign stocks have been making some noise lately as practically the entire globe has experienced a solid advance since the U.S. presidential election. And the noise is getting louder as these markets are registering some legitimate milestones in their rally.

A case in point involves the Global Dow Index (GDOW), an equally-weighted average of 150 of the largest stocks in the world. We like tracking it because it adheres very well to various technical charting analyses despite the fact that there is not much actual money traded based off of it.

Nevertheless, we have found the index to be a pretty reliable barometer of the health of the global equity market. If that is true, the global market keeps getting healthier and healthier.

Entering 2017, we mentioned that the GDOW was perhaps facing stiff resistance in the form of its post-2007 Down trendline. Well, after holding at that level for about a month, the index was able to break above the key trendline. Despite that breakout, though, we cautioned that there were still obstacles that may prevent a substantial, immediate rally. As stated in a late-January post:

“One immediate obstacle facing the GDOW is the lateral resistance in the 2640′s range, representing the 2014-2015 highs. Yesterday’s high in the index was 2638.54, so we are essentially there now. A pause here and possible test of the trendline breakout level near 2590 would not be a surprise.”

Well, our crystal ball was working that day as that proved to be the high for the rally. And the 2590 test call proved prescient as just 3 days later, the GDOW would drop to 2590.40. After testing the area once more at 2590.03 a few days later, the GDOW has bounced again. And over the past 2 days, the index has scored another milestone, surpassing the highs of 2014-2015 and setting a new 9-year high.

Does this mean we’re off to the races? Not quite. Given the extended nature of much of the equity market, especially in the U.S. (which does have a significant weighting in the Global Dow), the concern is that there may not be enough immediate-term fuel to propel a sustainable rally. That remains to be seen. The good news, for traders, is that the natural delineating line between success and failure, i.e.,

the former high, is just points away. Therefore, if one is “playing” this trade, either through the ETF (ticker, DGT), or simply by using the GDOW as a tell for their other positions, not much money needs to be risked here.

We’ve no idea whether this breakout will be sustained or not (we don’t actually have a crystal ball). However, based on this barometer, global stocks have already produced a number of positive milestones in recent months – something they sorely needed.

_____________

Like our charts and analysis? Get an all-access pass to our complete macro market analysis at our new site, The Lyons Share (plus, sign up by February 28

to take advantage of our special launch deal).

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.