The Biggest Stock Market Breakout In Decades?

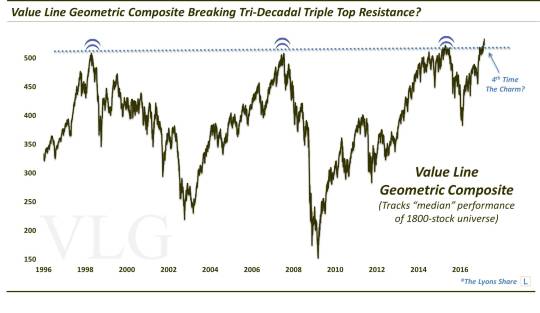

The broad-based Value Line Geometric Composite is threatening to break out above a triple top spanning 3 decades.

Back in December, amid the whole Dow 20,000 hoopla, we wrote a post suggesting instead that “THIS Is The Stock Market Level To Watch”. Despite the media fanfare, Dow 20K was all about a meaningless round number on a price-weighted index of just 30 stocks – hardly a development worth focusing on, much less obsessing over. Instead, we suggested that it was a historically relevant level on a broad-based index that deserved the focus of market participants.

As we stated in the December post:

The Value Line Geometric Composite (VLG), as we have explained many times in these pages, is an unweighted average that tracks the median stock performance among a universe of approximately 1800 stocks. Thus, in our view, it serves as perhaps the best representation of the true state of the U.S. equity market. Additionally, it has historically been very true to technical analysis and charting techniques, which is quite remarkable considering there are no tradeable vehicles based on it. And, as noted, the VLG is testing a monumental level at the moment, going back several decades.

That level, which we have been monitoring for years, represents a massive triple top spanning 3 decades. Specifically, the level near 510-520 marked the cyclical VLG tops in 1998 and 2007 and the series of intermediate-term tops in 2014-2015. That is why we mentioned that the “520-ish level in the Value Line Geometric Composite is the key level for investors to watch, in our view – even if no one has made up hats to commemorate it.”

In the aftermath of the initial post-election rally, the VLG found itself testing that 520 level around the time of our December post. At the time we cautioned against

“anticipating the breakout”, suggesting that “the Value Line Geometric Composite may well struggle initially at these levels, as it always has.” However, we also suggested that following a potential short-term pause, “this may be the VLG’s best chance yet to break this massive 3-decade resistance. The fact that it avoided a catastrophic selloff (e.g., 1998-2002, 2007-2009) this time before managing to return to its peaks suggests a higher level of demand (cup-&-handle?).”

Indeed, the VLG now appears to be attempting the long-awaited breakout above its multi-decade tops.

The VLG closed yesterday at an all-time record high around 529. Obviously that is above the 520 level so it encourages the notion of a breakout. Of course, there are no free lunches in the market so, while one may “play” the breakout, it needs to continue to be monitored for its sustainability. And given the extended nature of much of the market presently, this “breakout” may stand a higher chance than normal of failing, at least temporarily.

That said, price is truth, and as long as the VLG is above the 520-ish level – either presently or following a short-term pause – it has substantial potential upside. And as we stated in the December post:

“the significance probably cannot be overstated. This would be an extremely broad market gauge breaking out above 18-year, triple top peaks to new all-time highs. The short-term, and quite possibly long-term, ramifications could be exceedingly bullish.”

Perhaps not since the Dow Jones Industrial Average broke above its 16-year secular bear market tops back in 1983 has a U.S. stock index been in position to score such a prodigious breakout.

With or without the hats.

_____________

Like our charts and analysis? Get an all-access pass to our complete macro market analysis at our new site, The Lyons Share (plus, sign up by February 28 to take advantage of our special launch deal).

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.