French Stocks Encountering THE Piece De Resistance

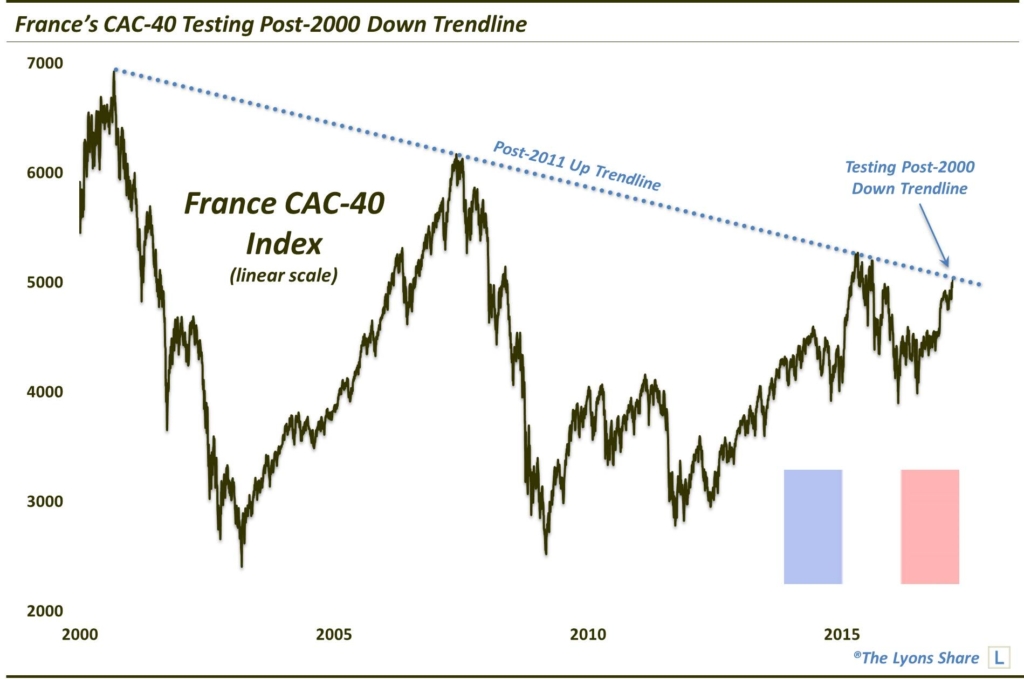

The French CAC-40 is testing a prolific trendline stemming back nearly two decades.

As most of you know, we post a fair number of charts containing trendlines (we even have a feature on Twitter called #TrendlineWednesday). It’s not that trendlines are a main focus of ours. But they’re a simple technical tool to employ, and to understand. That said, when utilized appropriately, trendlines can be much more effective than one might think, as today’s Chart Of The Day illustrates.

Of all the trendlines currently being engaged in financial markets, the one shown below on the French CAC-40 Index may be the most prolific. We have done other posts in the past pertaining to challenges to the index (utilizing the same corny Piece De Resistance headline), but this one takes the cake. We’re referring to the Down trendline stemming from the CAC-40’s 2000 high and connecting the 2007 and 2015 highs. Prices are presently very close to testing the trendline once again.

We actually covered the index’s test of the trendline back in 2015 – a test which obviously was successful upon examination of the present chart. Thus, this iteration of the trendline test still takes the cake.

Will the test be successful again and contain prices as it has for the past 17 years? We don’t have the answer but this prolific of a trend line should not be underestimated. However, given the relative momentum in stock markets across the European continent, this might be the CAC-40’s best chance yet at breaking this resistance.

_____________

Painting is the Battle of Waterloo by William Holmes Sullivan.

Like our charts and research? Get an All-Access pass to our complete macro market analysis, every day, at our new site, The Lyons Share .

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.