Is This Sector Ready To Take Off? (UNLOCKED-PREMIUM)

Airlines stocks may be close to completing a long-term bullish set-up almost 2 decades in the making.

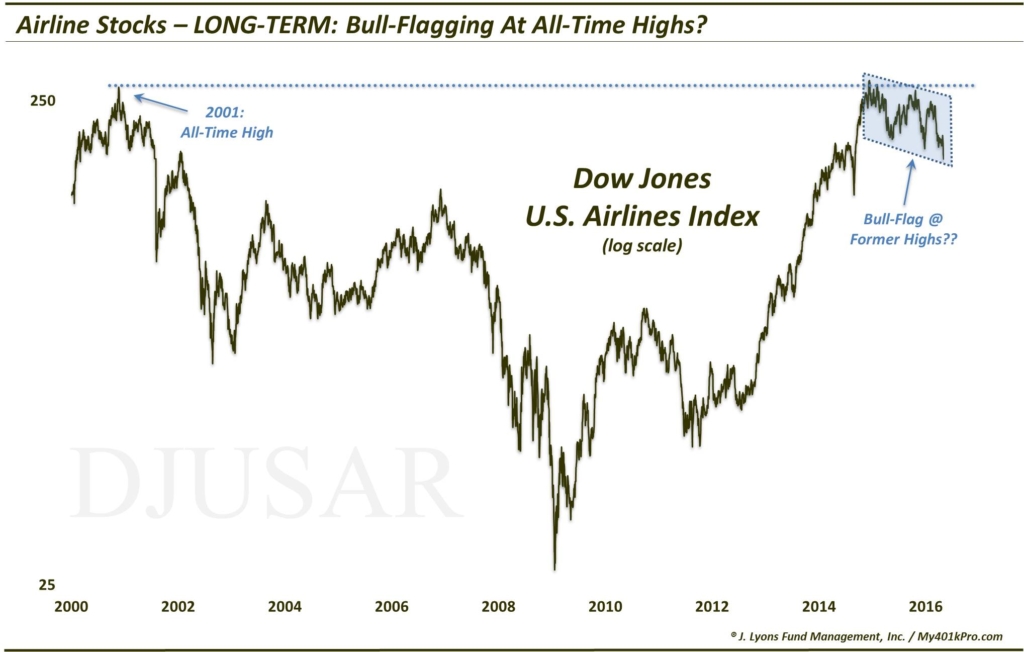

Last June, airlines stocks were in the midst of a thrashing, both in terms of prices which were hitting multi-year lows, as well as among the financial media and punditry. It was the chart, though, that compelled us to post a piece at the time, offering up a longer-term bullish assessment of the group. Here is the chart of the Dow Jones U.S. Airlines Index that we posted at the time.

As the chart shows, one interpretation (ours) was that the index was trading within a long-term bull flag, in the vicinity of its 2001 all-time high near the 270-280 level. As it turns out, the sector did indeed bottom later that month. And as things have unfolded, prices have done nothing to dissuade us from that interpretation. In fact, the chart evolved into a potentially even more bullish pattern when we posted an update in December.

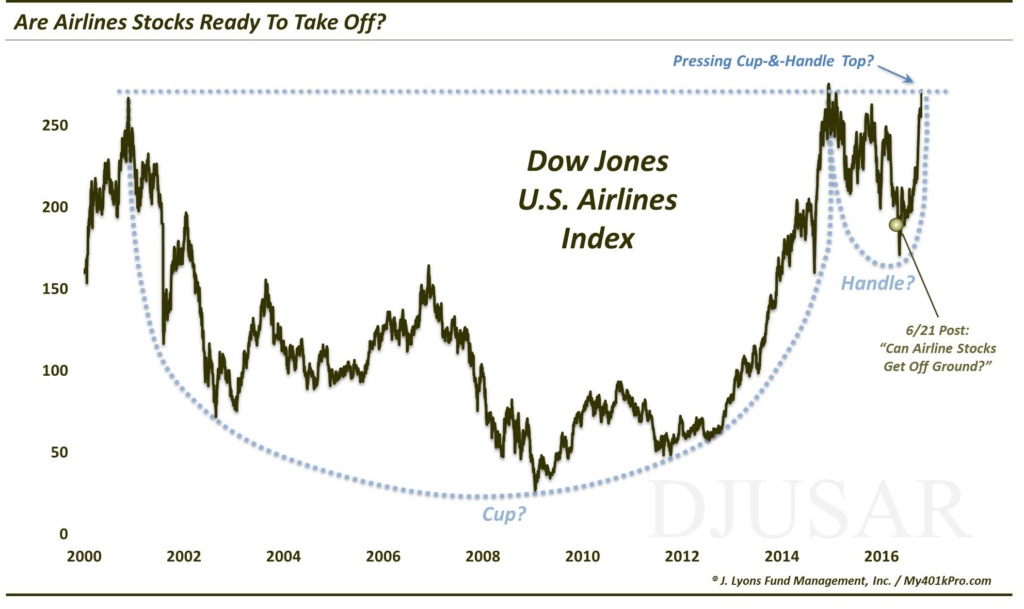

By the time of our December post, the the DJ Airlines Index had returned to the 280-ish level, thus morphing from the bullish-looking bull flag into a bullish-looking potential “cup-&-handle”. Once again, here is the construction and concept behind the cup-&-handle.

The pattern involves 2 parts, generally showing the following characteristics:

The Cup (2001-2015): This phase includes an initial high on the left side of a chart followed by a relatively long, often-rounded retrenchment before a return to the initial high.

The Handle (2015-2016): This phase involves a shorter, shallower dip in the security and subsequent recovery to the prior highs.

The bullish theory is predicated on the idea that after taking a long time for a stock to return to its initial high during the “cup” phase, the “handle” phase is much briefer and shallower. This theoretically indicates an increased eagerness on the part of investors to buy since they did not allow it to pull back nearly as long or as deep as occurred in the cup phase. Regardless of the theory, the chart pattern has often been effective in forecasting an eventual breakout and advance above the former highs.

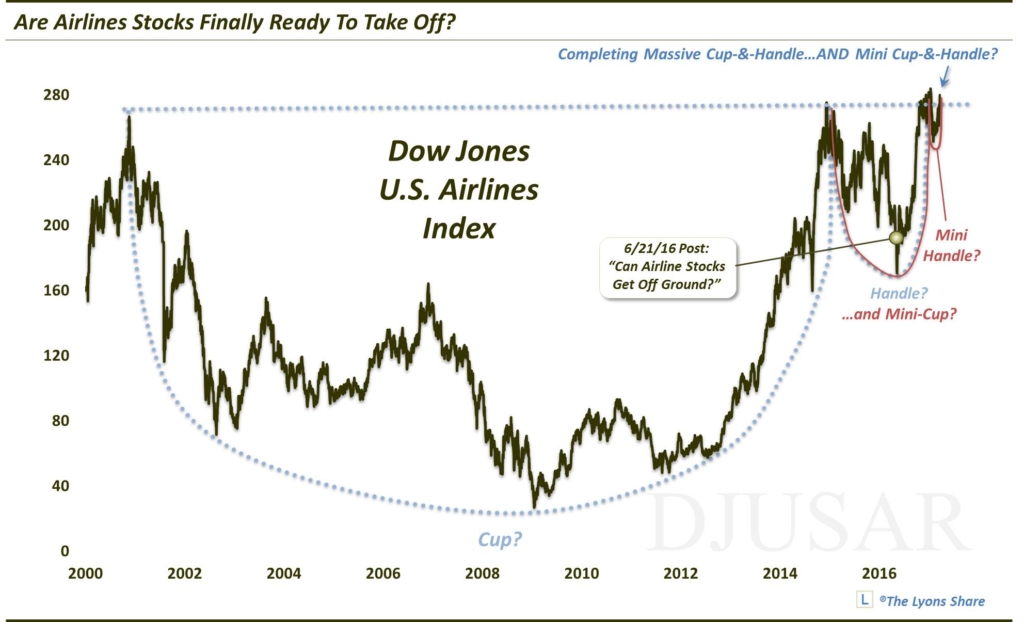

As it turns out, the Airline sector wasn’t quite ready to take flight. It has spent much of the past 5 months consolidating, then retracing, the 2nd half 2016 rally that made up the right side of the long-term “handle”. In the past 2 months, the Airline Index has gotten continually denied at the 61.8% Fibonacci Retracement of its sharp March decline. Finally — today — in the latest development on the chart, the index was able to surmount the 61.8% level and attack the 280 level once again.

In the process, the post-December action has resulted in the look of another potential “handle” formation. In this case, the “cup” of the formation is actually the 2015-2016 “handle” in the longer-term pattern. Thus, presently we have the index arguably testing the completion of multiple cup-&-handle formations. Of course, to really complete the patterns, the index will need to actually break out above the 280 level, instead of continuing to stall out there.

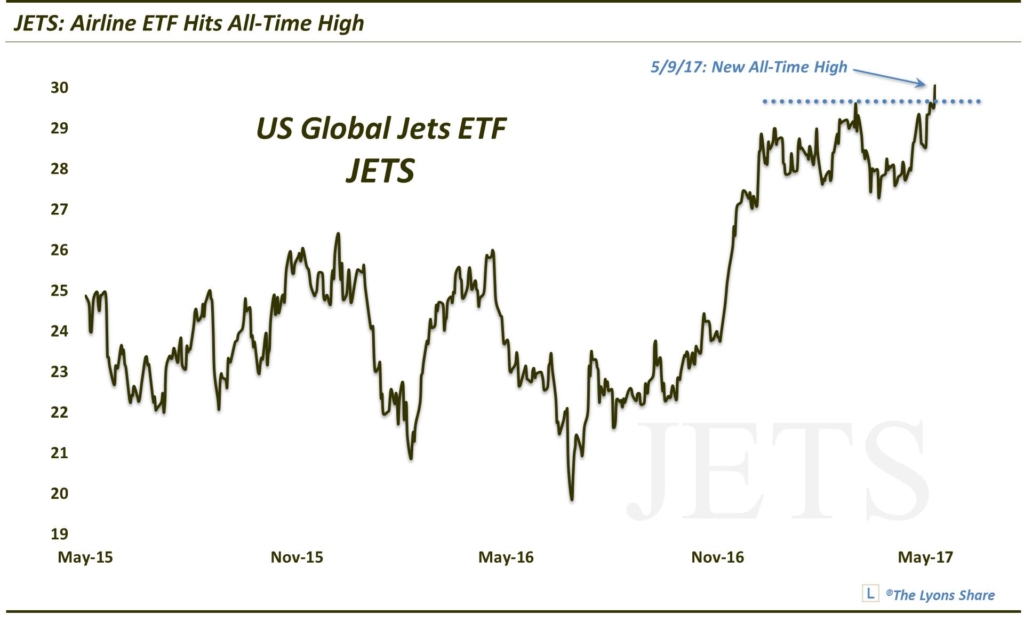

So how does one take advantage of this potentially large-scale opportunity? There is an airline ETF, the US Global Jets ETF (ticker, JETS), that was launched following the huge 2013-2014 runup — thanks, ETF industry! Actually, to make matters worse, there was a prior ETF (FAA) that was shuttered in early 2013, missing out on a 200%+ rally.

Anyway, JETS has tracked the Airline Index pretty well — even out-performing it during its 2-year history. That includes a post-election breakout above its prior highs of 2015-2016. And it now includes a breakout, today, above its December-May consolidation range.

In terms of individual airlines stocks, several look attractive, including United Continental Holdings, Inc.. ticker, UAL, which looks to have scored a breakout today of a similar 2015-2017 cup-&-handle pattern as the index. Additionally, Southwest (LUV) continues to be a rock, though an extended one, as it has been continuously hitting new all-time highs over the past few years.

So those are a few ways to play this much-maligned industry that looks poised to finally embark on a long flight higher.