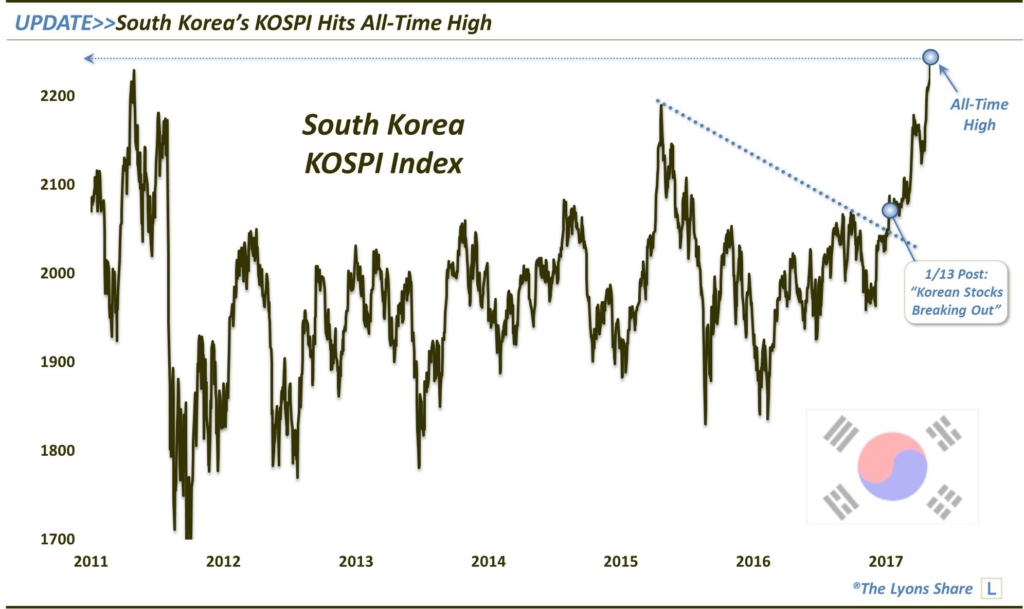

Korean Stocks Cross The Border

Amid geopolitical turmoil, the South Korean Kospi just hit a new all-time high.

If one was using news headlines in order to direct their investment decisions, South Korea would probably be one of the last options on their list. Given the tantrum currently being thrown in North Korea, intuition might suggest that the stock market in South Korea would be on edge — or off the edge. It would almost certainly not suggest that Korean stocks are in the midst of a sharp rally that has taken them to new all-time highs for the first time in 6 years. Yet, that is reality.

Back on January 13, we noted that South Korea’s main stock index, the Kospi, had surmounted key resistance near the 2050 level. As we stated, with “…serious resistance near 2050 cleared, a potential path to its April 2015 highs near 2170 is not unreasonable.” Within 2 months, the Kospi had indeed reached that 2170 level. And after a month-long digestion near that level, the Kospi would do one better, hitting an all-time high today of 2241.

The U.S. stock market is 8 years into a cyclical bull market, spending the latter half of that period as just about the only game in the global equity town. Thus, we have been suggesting to investors recently, and often, that they may want to keep an open mind about more international exposure in their equity portfolio. This mindset has been supported by the fact that we’ve seen countless positive technical developments in markets around the globe thus far in 2017.

South Korea is no exception. And if the Kospi can move to new highs decisively, and hold there, the South Korean market may have just about as much upside potential as any market.

Like our charts and research? Get an All-Access pass to our complete macro market analysis, including tons of charts and ideas like this EVERY DAY, at our new site, The Lyons Share.

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.